Prospect Capital’s Increasing Valuations in 2017

Analysts have given PSEC a one-year price target of $8.50 from the current price level, reflecting 0.7% growth.

June 1 2017, Updated 9:07 a.m. ET

Positive outlook

Prospect Capital (PSEC) has been giving decent returns to its shareholders and as a result, investors seem positive for the upcoming quarters. Analysts have given PSEC a one-year price target of $8.50 from the current price level, reflecting 0.7% growth.

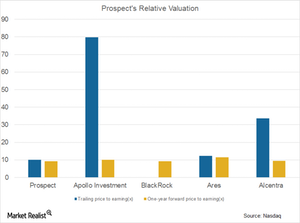

Prospect Capital’s trailing price-to-earnings (or PE) ratio stands at ~10.1x. Its one-year forward price-to-earnings ratio stood at ~9.3x compared to its competitors’ average one-year forward PE ratio of ~9.9x. The company is trading at a discount to its one-year forward PE ratio. If the Federal Reserve doesn’t implement further rate hikes in 2017, the company’s interest income could be affected.

Prospect Capital’s (PSEC) current PE ratio is higher due to its lower EPS (earnings per share). The lower EPS resulted from lower interest income. BlackRock Capital Corporation’s (BKCC) one-year forward PE ratio stands at ~9.3x. PSEC’s other competitors have the following forward price-to-earnings ratios:

Expected performance

On a relative basis, Prospect Capital (PSEC) is expected to see improved performance in the upcoming quarters. This improvement could result from higher dividend yields compared to its competitors’ dividend yields.

For the upcoming months, Prospect Capital has declared distributions on a monthly basis. Also, on a last-12-month basis, PSEC stock has risen ~25%. In 2017 year-to-date, Prospect Capital stock has risen ~9%.

Apollo Investment (AINV), BlackRock Capital Investment Corporation (BKCC), and Ares Capital Corporation (ARCC) jointly comprise ~26.5% of the VanEck Vectors BDC Income ETF (BIZD).

In the next part, we’ll see what analysts have to say about Prospect Capital (PSEC).