VanEck Vectors BDC Income ETF

Latest VanEck Vectors BDC Income ETF News and Updates

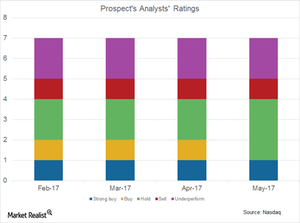

Prospect Capital’s Ratings: What Wall Street Analysts Have to Say

Although Prospect Capital (PSEC) has been delivering decent returns to investors, there has not been much change in the analysts’ ratings.

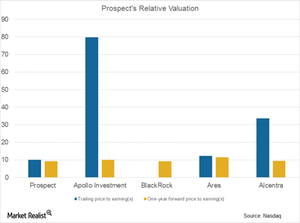

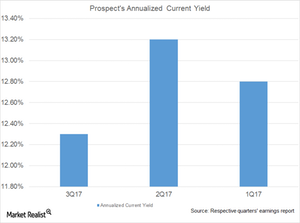

Prospect Capital’s Increasing Valuations in 2017

Analysts have given PSEC a one-year price target of $8.50 from the current price level, reflecting 0.7% growth.

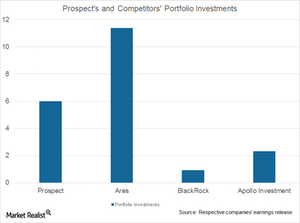

Prospect Capital’s Total Investments Increase in 2017

In fiscal 3Q17, Prospect Capital’s total value of investments stood at $6.0 billion in 125 companies, compared to $5.9 billion in fiscal 2Q17 in 123 companies.

Prospect Capital Prioritizes Secured Lending

About 70% of Prospect Capital’s portfolio is composed of first and second lien secured loans

Prospect Capital Adopts a Conservative Approach in Fiscal 3Q17

Prospect Capital’s (PSEC) originations decreased in fiscal 3Q17 to $449.6 million compared to $469.5 million in fiscal 2Q17.

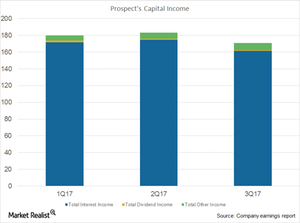

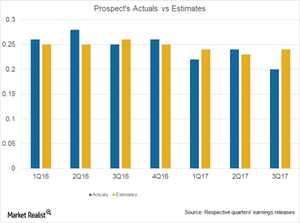

Prospect Capital’s Disappointing Performance in Fiscal 3Q17

Prospect Capital (PSEC) reported a decline in its net investment income in its fiscal 3Q17 earnings. Analysts expect PSEC’s fiscal 4Q17 EPS to reach $0.20, representing no change from fiscal 3Q17.