Prospect Capital Prioritizes Secured Lending

About 70% of Prospect Capital’s portfolio is composed of first and second lien secured loans

May 31 2017, Updated 10:39 a.m. ET

Purchases of senior secured first lien

RME Holding Group Company, also known as LeadingResponse, has made an issue of $64.5 million senior secured first lien floating-rate notes, which are being purchased by Prospect Capital (PSEC).

With the help of differentiated lead generation activities, LeadingResponse provides a high return on investment by offering new customer acquisition service. As a result, Prospect Capital holds a positive outlook on this investment.

Prospect Capital’s portfolio in fiscal 3Q17 comprised:

- secured first lien: 48.8%

- structured credit: 17.8%

- secured second lien: 20.5%

- equity investments: 12.0%

- small business whole loan: 0.2%

- unsecured debt: 0.7%

About 70% of Prospect Capital’s portfolio is composed of first and second lien secured loans, with first liens constituting the major portion of its holdings.

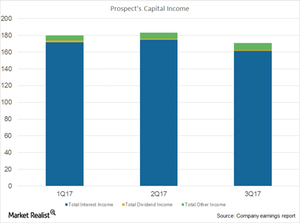

Investment income

In fiscal 3Q17, Prospect Capital’s (PSEC) controlled investments constituted 31.4% of its total investments portfolio at fair value. Of its total interest income, its controlled investments stood at $41.4 million in fiscal 3Q17 compared to $50.8 million in fiscal 3Q16.

As a result, PSEC saw declining interest income in fiscal 3Q17 to $161.7 million compared to $179 million in fiscal 3Q16. This trend is mainly due to a reduction in expected future cash flows. As a result, the company had decreasing returns in its structured credit investments. Reduction in interest rates on investments made by Prospect Capital in First Tower Finance also contributed to decreasing interest income.

Dividend income

Prospect Capital’s (PSEC) dividend income resulted in a decline from $8.3 million in fiscal 3Q16 to $0.8 million in fiscal 3Q17. This decline occurred because no dividends were received from Prospect Capital’s investment in Echelon in fiscal 3Q17.

In fiscal 3Q16, PSEC received $7.3 million in dividends from the same investment. Dividends also decreased by $0.2 million in fiscal 3Q17 compared to fiscal 3Q16 from Prospect Capital’s investment in Nationwide.

PSEC’s competitors

On a relative basis, Prospect Capital’s (PSEC) competitors reported an increase in their respective dividend income figures.

Ares Capital Corporation (ARCC) reported dividend income of $24 million in 1Q17 compared to $16 million in 1Q16. BlackRock Capital Corporation (BKCC) also reported an increase in dividend income. In 1Q17, BlackRock reported $2.0 million compared to $1.5 million in 1Q16.

Together, Ares Capital Corporation (ARCC), BlackRock Capital Corporation (BKCC), and Apollo Investment Corporation (AINV) comprise ~26.5% of the VanEck Vectors BDC Income ETF (BIZD).

Other income

Other income also constitutes part of Prospect Capital’s (PSEC) investment income, including structuring fees. Other income is generally created from originations, which could fluctuate according to the types and levels of originations. Including structuring fees, other income increased in fiscal 3Q17 to $8.5 million compared to $2.2 million in fiscal 3Q16.

Structuring fees have also increased from $0.2 million in fiscal 3Q16 to $6.8 million in fiscal 3Q17. This increase is mostly due to increased new originations in Memorial MRI and Centerfield. This increase also resulted from follow-on investments in Prospect Capital’s portfolio companies.

In the next article, we’ll look at the company’s distribution policy.