Prospect Capital Adopts a Conservative Approach in Fiscal 3Q17

Prospect Capital’s (PSEC) originations decreased in fiscal 3Q17 to $449.6 million compared to $469.5 million in fiscal 2Q17.

May 31 2017, Updated 9:10 a.m. ET

Target segment

Comprising a team of more than 100 professionals, Prospect Capital (PSEC) focuses on middle-market lending. Prospect Capital generally makes investments in companies with annual EBITDA[1. earnings before interest, tax, depreciation, and amortization] of $5 million–$150 million.

Prospect Capital invests in small and medium-sized enterprises that prioritize secured lending. PSEC reported decreasing numbers in weighted average portfolio EBITDA in fiscal 3Q17, standing at $49.4 million compared to $51.6 million in fiscal 2Q17.

PSEC’s investment portfolio

In fiscal 3Q17, Prospect Capital’s (PSEC) investment portfolio consisted of 125 portfolio companies with a fair value of $6 billion. In fiscal 2Q17, PSEC held 123 portfolio companies with a fair value of $5.9 billion. National Property REIT Corp. held the top position, comprising 9.4% of PSEC’s investment portfolio.

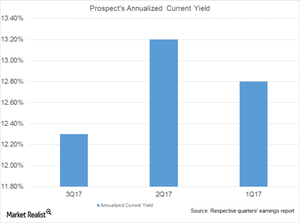

PSEC is adopting a conservative approach by increasing the number of companies in its portfolio. The company is marginally increasing the fair value of its portfolio in order to improve its returns. Prospect Capital’s annualized current yield fell to 12.3% in fiscal 3Q17 compared to 13.2% in fiscal 2Q17, mostly due to deployments in lower interest-bearing investments.

On a relative basis, Prospect Capital has been performing better than its competitors, which reported the following current yields:

- Apollo Investment Corporation (AINV): ~9.3%

- BlackRock Capital Corporation (BKCC): ~9.4%

- Alcentra Capital Corporation (ABDC): ~10.2%

Together, these companies comprise ~7.1% of the VanEck Vectors BDC Income ETF (BIZD).

Originations and repayments

Prospect Capital’s (PSEC) originations decreased in fiscal 3Q17 to $449.6 million compared to $469.5 million in fiscal 2Q17. Its allocations follow:

- third-party sponsor deals: 66%

- real estate: 10%

- syndicated debt: 12%

- operating buyouts: 4%

- online lending: 6%

- structured credit: 2%

Prospect Capital’s repayments in fiscal 3Q17 stood at $302.5 million. Apart from the deployments in new originations, Prospect Capital is also planning to increase its income with the help of extensions and refinancings in its online lending business.

Although the company’s REIT, NPRC, currently has real estate assets of ~$2.1 billion, PSEC and NPRC are currently focusing on near-prime, prime, and super-prime consumers in terms of investing in the online lending industry. This trend is mainly due to the company’s and NPRC’s online business generating more than 12% ROIC.[2. return on invested capital] In fiscal 3Q17, Prospect Capital and NPRC owned online loans worth $785.5 million.