How Long Can Thermo Fisher Scientific’s Asia-Pacific Growth Momentum Last?

Thermo Fisher Scientific (TMO) has a presence around the globe, but around 80% of its revenues are generated from developed markets.

June 1 2017, Updated 9:08 a.m. ET

TMO’s regional overview

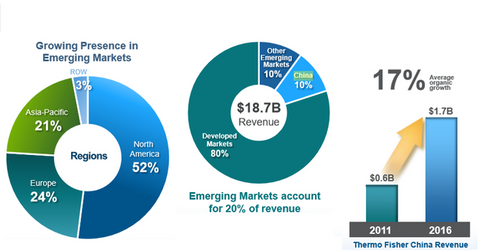

Thermo Fisher Scientific (TMO) has a presence around the globe, but around 80% of its revenues are generated from developed markets. Emerging markets constitute 20% of the company’s total revenues, and China is the largest market, contributing 10% of the company’s total revenues.

In 1Q17, TMO’s North America revenues grew in low-single-digits, while Europe grew in the mid-single digits, and the rest of the world registered flat organic growth.

Growth in Asia-Pacific and other emerging markets

Asia-Pacific sales constitute around 21% of TMO’s total sales. In 1Q17, China led the growth in Asia-Pacific. While Asia-Pacific grew in low double digits, China registered growth in the high teens. India and South Korea also reported strong sales.

TMO continues to focus on expanding its access to these markets and gaining market share. The company recently opened a new customer demonstration laboratory for cryo-electron microscopy at Tsinghua University. China sales have witnessed an average organic growth of around 17% over the past five years.

TMO has leveraged its scale and depth in this market and has implemented commercial leadership and localization strategy benefits to gain higher market share. The company is also advancing its presence in the region by using digital marketing capabilities that have helped it harness the cross-selling opportunities.

Applied markets, major competitors

Applied markets, especially in Asia-Pacific, are also new opportunity areas for TMO in the wake of global regulation changes.

TMO’s major competitors include Medtronic (MDT), Abbott Laboratories (ABT), and Boston Scientific (BSX), all of whom are focusing on new opportunities in Asia-Pacific—especially in emerging markets. Investors seeking to gain exposure to TMO can invest in the Vanguard Health Care ETF (VHT), which has ~2% of its total holdings in TMO.

Now let’s discuss the innovation strategy driving TMO’s growth.