Energy Stock Valuations and Their Historical Averages

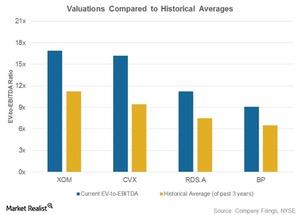

EV-to-EBITDA multiples in 1Q17 for ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) were above their historical averages.

May 15 2017, Updated 7:35 a.m. ET

Energy stock valuations

Let’s look now at integrated energy stocks’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiples in 1Q17 compared to their three-year historical averages. EV-to-EBITDA multiples in 1Q17 for ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) were above their historical averages.

XOM’s valuation multiple comes in at the top

XOM’s valuation multiple is the highest among its peers at 16.9x. It’s also above its historical EV-to-EBITDA multiple, which is 11.2x. The current EV-to-EBITDA multiples for CVX, RDS.A, and BP are 16.2x, 11.2x, and 9.1x, respectively, compared to their historical multiples of 9.4x, 7.5x, and 6.5x, respectively.

These leading integrated energy stocks are trading at valuations above their historical averages. That’s most likely due to higher 2017 average oil prices providing hope to investors that better oil prices could lead to improved financials for these companies in the near future.

For exposure to core S&P Index stocks, you can consider the SPDR S&P 500 ETF (SPY). SPY has a ~6.0% exposure to energy sector stocks, including XOM and CVX.