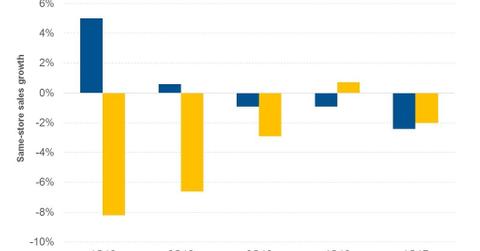

Why Baskin-Robbins Had Negative Same-Store Sales Growth in 1Q17

In 1Q17, Baskin-Robbins, which operates under the umbrella of Dunkin’ Brands (DNKN), had SSSG of -2.4% in the United States and -2.0% in international markets.

May 11 2017, Updated 7:36 a.m. ET

1Q17 performance

In 1Q17, Baskin-Robbins, which operates under the umbrella of Dunkin’ Brands (DNKN), posted SSSG (same-store sales growth) of -2.4% in the United States and -2.0% in its international markets.

Factors that led to the fall in SSSG for Baskin-Robbins

Declining traffic offset Baskin-Robbins’s gains from rising average ticket size to post negative SSSG in the United States. Baskin-Robbins U.S. blamed the cold weather in March 2017 for negative SSSG.

In the international market, Baskin-Robbins posted SSSG of -2.0%. Strong performances in Asia, South Korea, and Canada were offset by weak sales in the Middle East and Japan. The company’s management blamed instability around the world for negative SSSG.

Outlook

To improve SSSG, Baskin-Robbins’s management is focusing on enhancing customer experience through the launch of a new mobile app (application) and testing delivery services at more markets.

In international markets, the company is focusing on enhancing customer experience, expanding convenience, and increasing transactions. The company has implemented a delivery program in 30 delivery hubs in Saudi Arabia. It has also launched a Dunkin’ Donuts app in Germany, which has been downloaded nearly 100,000 times. All these initiatives are expected to drive Baskin-Robbins’s SSSG to the low single digits in 2017.

ETF exposure

You can gain exposure to Dunkin’ Brands by investing in the iShares Russell Mid-Cap Growth (IWP), which has invested 0.17% of its holdings in Dunkin’ Brands. IWP has also invested 0.46%, 0.35%, and 0.33% in Chipotle Mexican Grill (CMG), Darden Restaurants (DRI), and Domino’s Pizza (DPZ), respectively.

Next, we’ll look at unit growth for both Dunkin’ Donuts and Baskin-Robbins.