Using Asian Markets’ Low Correlation with US Markets

The correlation between US and international markets varies depending on market cycles.

May 31 2017, Updated 12:05 p.m. ET

Matthews Asia

A long-held tenet of international diversification has been that the low correlation with U.S. stocks provides a diversification benefit by reducing the volatility of the investor’s total portfolio. With increasing globalization of the developed markets, the correlation between MSCI EAFE and the S&P 500 has increased in recent years. Asian market indices have lower correlations with the U.S. than the MSCI EAFE Index, and the opportunities outlined in this paper show the potential for high returns. In hindsight, Asia Pacific ex Japan was better at increasing risk-adjusted returns for a U.S. equity investor portfolio over the 25 years ending 2015 than was EAFE, the benchmark approach actually used by many allocators.

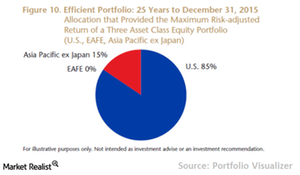

The benefit of low correlation becomes clear when calculating the most efficient portfolio, i.e. the one that maximizes the risk-adjusted return (or Sharpe ratio). Comparing the historical returns for the S&P 500, MSCI EAFE and MSCI AC Asia Pacific ex Japan indices over the 25-year period 1991–2015, the most efficient empirical portfolio over that period would have held only 85% U.S. equity. The other 15% in that efficient portfolio however was not EAFE (which received a zero allocation), but Asia Pacific ex Japan.

Market Realist

Asian markets’ low correlation with US markets

The correlation between US and international markets varies depending on market cycles. During intense volatility, correlation often approaches 1.0, while during market stability, it’s normally lower. According to the American Association of Individual Investors, the S&P 500’s (SPY) correlation with the MSCI EAFE (Europe, Australasia, Far East) Index was as high as 0.99 between 2005 and 2009. However, over 40 years, the average correlation between US and international markets was lower at around 0.59.

Over the ten-year period ended April 2015, the iShares Core S&P 500 ETF (IVV), which represents US stocks, had a correlation of 0.88 with the iShares MSCI EAFE ETF (EFA), which represents global stocks (excluding the United States and Canada).

On the other hand, over the ten-year period ended April 2017, the SPDR S&P 500 ETF (SPY) had a correlation of 0.90 with the SPDR MSCI ACWI ex-US ETF (CWI) and a much lower correlation of 0.70 with the SPDR S&P Emerging Asia Pacific ETF (GMF). These correlations clearly indicate that Asian funds provide better diversification benefits than popular global benchmarks. Low correlation reduces the volatility of a portfolio while enhancing risk-adjusted returns.