How Refundings Could Affect Municipal Bond Returns This Year

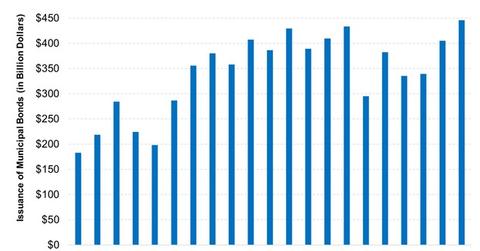

Municipal bond issuance has been rising over the last few years. More refundings would cause the supply to rise further.

April 5 2017, Published 12:32 p.m. ET

VanEck

BUTCHER: What do you see as the greatest uncertainties at the moment and going forward?

COLBY: I see two. One is refundings and the other is tax reform, which was at the heart of the market’s move in November and December.

Whether some type of tax reform can take place in the next 90 or 100 days is certainly open to question. The potential for a change in corporate and individual tax rates is a big wild card. And if interest rates remain relatively stable in the current low-rate environment, there could be plenty of refundings — which would add to muni supply — even if the Fed raises the Fed funds rate in March or May by 25 or 50 basis points. This creates some balance between inflows and the supply-demand equation and augurs well for muni performance through the first half of the year.

Market Realist

The above graph shows the total issuance of municipal bonds (XMPT) over the last two decades. As you can see, municipal bond issuance has been rising over the last few years. More refundings would cause the supply to rise further. But as we mentioned in the previous part of this series, demand for municipal bonds, especially from foreign investors, is likely to put a floor on municipal bond prices.

As interest rates begin to rise, bond investors look to diversify their portfolios to mitigate the interest rate risk. The above graph compares the returns on Treasuries and municipal bonds in past periods of rate hikes. While Treasuries (IEF) underperformed when rates rose, AAA-rated and BBB-rated municipal bonds saw solid returns.

During those same periods, BBB-rated municipal bonds outperformed AAA-rated municipal bonds. That’s because rates usually rise when the economy is improving. Better economic conditions lead to better revenues for companies with lower credit quality. So lower-rated municipal bonds could be an option to consider as rates rise. While high-yield corporate bonds (HYG) also perform well when rates rise, their valuations seem slightly rich after last year’s outperformance.