How Recent Acquisitions Have Enhanced PAA’s Permian Footprint

In February 2017, Plains All American Pipeline (PAA) closed the acquisition of a Permian Basin crude oil gathering system for $1.2 billion.

April 28 2017, Updated 4:09 p.m. ET

Crude oil gathering system

In February 2017, Plains All American Pipeline (PAA) closed the acquisition of a Permian Basin crude oil gathering system for $1.2 billion.

“We expect aggregate crude oil production on the dedicated acreage to double over the next two to three years, and we believe that overall Permian Basin crude oil volumes have the potential to grow as much as 50% or more during this same time period,” said Greg Armstrong, chairman and CEO of PAA, in a related press release.

“Additionally, we expect to realize meaningful synergies with our existing assets and generate attractive investment returns relative to our cost of capital,” added Armstrong.

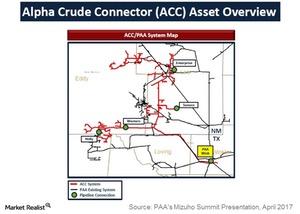

The above image shows Plains All American’s Alpha Crude Connector system map. These assets are underpinned by long-term acreage dedications with significant undedicated acreage positions. Concho Resources (CXO) is the “anchor shipper, basin” and acreage dedication includes “a large area of mutual interest.” Moreover, there are acreage dedications from several other producers.

Plains All American Pipeline noted that expects “over 3 decades of inventory at current rig count” on Alpha Crude Connector dedicated acreage.

PAA’s Permian footprint

The above map shows Plains All American Pipeline’s asset footprint in the Permian Basin. In addition to the Advantage Pipeline joint venture and Alpha Crude Connector system discussed in this and the previous part, PAA is expanding capacity on its Cactus pipeline from McCamey to Gardendale, Texas.

This expansion is expected to be completed in 3Q17. The BridgeTex Pipeline, in which PAA owns 50% interest, is also expanding its capacity.