Inside Norfolk Southern’s Freight in Week 28

CSX’s (CSX) overall railcar traffic rose 3.1% in the 28th week of 2017 (ended July 15).

Nov. 20 2020, Updated 5:09 p.m. ET

CSX’s railcar traffic in week 28

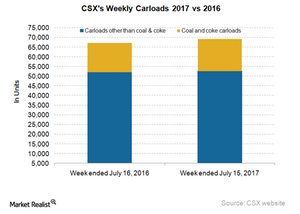

CSX’s (CSX) overall railcar traffic rose 3.1% in the 28th week of 2017 (ended July 15). The Jacksonville-headquartered railroad hauled over 69,000 railcars, compared with ~67,000 railcars in the week ended July 16, 2016.

Unlike Norfolk Southern (NSC), CSX’s carloads other than coal and coke improved 1% last week. Railcars excluding coal and coke for CSX totaled ~53,000, up from 52,000 during the same week last year.

On a year-to-week basis, CSX’s railcar traffic expanded by just 0.7% as of July 15, while for US railroads, the overall the rise was 6%.

CSX’s coal and coke (CNX) carloads registered a growth of ~10% in the week ended July 15, 2017. This was almost equal to the rise reported by NSC in the same category. CSX moved ~17,000 railcars of coal and coke, compared with 15,000 railcars in the same week last year.

Norfolk Southern’s coal (TCK) carloads grew 22% in the first 28 weeks of the year, compared with CSX’s 7.2%.

CSX’s intermodal traffic

CSX saw its intermodal volumes growing at a higher rate than its railcar traffic. In the 28th week, the company recorded a 5.2% YoY (year-over-year) growth in intermodal units. The company hauled over 54,000 containers and trailers, compared with 51,500 units during the same week last year.

Containers accounting for ~95% of overall intermodal traffic reported a 5.5% YoY growth to ~52,000 containers. Trailer units contracted by 2.4% YoY to ~2,000 trailers.

CSX has lagged behind the overall industry in intermodal growth for the first 28 weeks of 2017. The company’s intermodal traffic has risen 1.6% YoY, however, compared with the 2.9% YoY growth registered by US railroads overall.

Investing in ETFs

Investors looking to invest in transport and logistics stocks can opt for the VanEck Vectors Morningstar Wide Moat ETF (MOAT), which has the entire US-originated railroad group in its portfolio.