A Look at McCormick’s Strong Dividend History

In the past three fiscal years, McCormick has returned more than $1.0 billion to its shareholders in the form of dividends and share buybacks.

April 11 2017, Updated 7:36 a.m. ET

Shareholder returns

McCormick (MKC) has a strong track record of rewarding investors with increased dividends and share buybacks. In fiscal 2016, which ended November 30, 2016, it returned $460.5 million to its shareholders in the form of $242.7 million in share buybacks and $217.8 million in dividends. In the past three fiscal years, McCormick has returned more than $1.0 billion to its shareholders in the form of dividends and share buybacks.

Dividend growth and yield

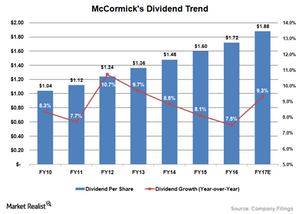

McCormick is a dividend aristocrat, which means it has increased its dividends for more than 25 years in a row. In fact, it has increased its dividends for 31 consecutive years. In November 2016, management announced a 9.3% hike in its quarterly dividend to $0.47, from $0.43.

In simple terms, dividend yield indicates how much cash flow investors could potentially receive for every dollar they invest in a company. McCormick’s current dividend yield is 1.9%, based on its closing price of $100.08 as of April 6, 2017.

By comparison, McCormick’s current dividend yield is lower than the yields for General Mills (GIS), ConAgra Brands (CAG), and JM Smucker (SJM) at 3.3%, 2.0%, and 2.2%, respectively.

Future returns

Although McCormick lags its peers in terms of dividend yield, the company has been increasing its dividends at a healthy rate. As part of its long-term strategy, management stated that investors can expect dividends to increase 9.0%–11.0% in the coming years, which is in line with its projected growth for its bottom line over the same period.

As a dividend aristocrat, McCormick is included in the holdings of the SPDR S&P Dividend ETF (SDY), which invests in companies that have grown their dividends for at least 20 consecutive years. SDY has about 0.90% of its holdings in McCormick.

In the next part of this series, we’ll focus on analyst ratings for McCormick.