Is Surging Volatility Giving Gold a Backbone?

As the markets experienced unrest on Tuesday, April 11, gold touched its five-month high of $1,275.10 per ounce.

April 13 2017, Published 11:49 a.m. ET

Volatility surges

As the markets experienced unrest on Tuesday, April 11, gold touched its five-month high of $1,275.10 per ounce. The CBOE volatility index, or the VIX, measures uncertainty in the market and traded more than 7.0% higher at 15.1% on the day. The VIX was trading close to 10.0% during the previous day.

The recent launch of US Tomahawk cruise missiles was unable to push the VIX higher. For further details of this event, please read How US Tomahawk Cruise Missiles Gave a Base to Gold. However, the unrest in North Korea along with Russian tension caused a rise in the VIX.

Considered the best gauge of the market’s fear sentiment, the VIX index jumped to its highest level since just after President Trump’s election in November 2016.

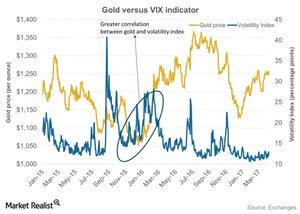

The market’s current volatility could give a positive bounce to gold. When higher volatility suggests unrest, haven assets like gold can rise. Gold’s correlation with market volatility, as depicted above by the CBOE volatility index, was high during 4Q15, when the first interest rate hike in almost a decade took place.

Volatility and gold

However, the volatility markets (VIXY) (VXX) have displayed strange behavior recently, and volatility has been dropping since November 2016. As a result, investors in the volatility market are facing losses. The VIX index sank to its three-year low in January 2017.

The rise in gold and other precious metals on April 11 also caused an increase in funds like the Physical Silver Shares ETF (SIVR) and the Physical Swiss Gold Shares ETF (SGOL). These two funds jumped 1.9% and 1.4%, respectively, on April 11.

Among the miners, Kinross Gold (KGC), Alacer Gold (ASR), Pan American Silver (PAAS), and Eldorado Gold (EGO) rose 3.6%, 4.5%, 1.0%, and 2.3%, respectively, on April 11. These four miners contribute 9.5% to the VanEck Vectors Gold Miners ETF (GDX).

Let’s look at gold’s technicals in our next article.