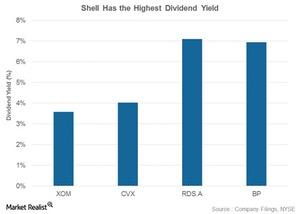

Integrated Energy Stocks: Who Stands Tall in Dividend Yield?

Shell’s dividend yield is 7.1%, the highest among the integrated energy stocks in this series.

April 4 2017, Updated 1:35 p.m. ET

Dividend yields for integrated energy stocks

ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have consistently given returns to shareholders in the form of dividends. We’ve evaluated the dividend yields of these integrated energy companies. The yield is calculated as a ratio of the annualized dividends to the price of the stock.

The highest dividend yield

Shell’s dividend yield is 7.1%, the highest among the integrated energy stocks in this series. It’s followed by BP with a 7.0% yield. ExxonMobil (XOM) has the lowest yield among our four stocks at 3.6%. Chevron’s dividend yield stands at 4.0%.

For exposure to high dividend stocks, you can consider the iShares Core High Dividend (HDV). HDV has a ~16.0% exposure to energy sector stocks, including XOM and CVX.

In the next part of this series, we’ll do a cross-sectional analysis of integrated energy stocks’ forward valuations.