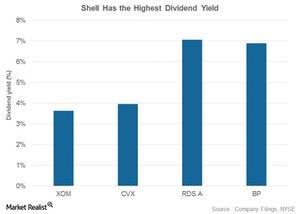

Inside Integrated Energy’s Dividend Yields: Comparing XOM, CVX, RDS.A, and BP

ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have consistently given returns to shareholders in the form of dividends.

April 18 2017, Updated 7:36 a.m. ET

Dividend yields

ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have consistently given returns to shareholders in the form of dividends. In this sense, comparing these firms on a dividend yield parameter becomes vital. Remember, the dividend yield is estimated as a ratio of the annualized dividends to the price of a stock.

Shell has the highest dividend yield among our group of four select integrated energy stocks, standing at 7.1%. Just behind Shell is BP, with a 7% yield. ExxonMobil (XOM) has the lowest yield among the four stocks at 3.6%. Chevron’s dividend yield stands at 4%.

For exposure to high dividend stocks, you might consider the iShares Core High Dividend ETF (HDV), which has ~16% exposure to energy sector stocks, including XOM and CVX.

Continue to the next part for an analysis of these four integrated energy stocks’ forward valuations.