Is Frontier Airlines’ Business Model Sustainable?

One of the major risks to Frontier Airlines is the fact that almost 45% of its flights originate from a single hub—Denver.

April 5 2017, Updated 4:05 p.m. ET

Concentration risk

One of the major risks to Frontier Airlines is the fact that almost 45% of its flights originate from a single hub—Denver. Although it’s much better than 90% flight origination from Denver in 2013, the concentration risk remains.

Better than Spirit Airlines?

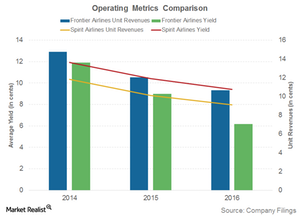

In its S-1 form filing, Frontier Airlines describes itself as a premier brand compared to other ultra-low-cost carriers like Spirit Airlines (SAVE) and Allegiant Travel (ALGT). It focuses more on customer experience, transparency in fees charged, and retaining some basic free amenities like free water (charged at SAVE). According to the filing, its “Low Fares Done Right” strategy helped the airline attract repeat business and generate higher unit revenues. After verification, this seems to be true. Spirit Airlines’ total revenue per available seat mile was $0.091 in 2016—lower than Frontier Airlines’ unit revenue of $0.093.

However, Frontier’s average yield per passenger mile of $0.06 is below Spirit Airlines’ yield of $0.11. Falling yields and unit revenues plagued Spirit Airlines and Frontier Airlines. The stock price was also impacted.

Frontier Airlines’ unit revenues fell 11.4% in 2016 and 18.5% in 2015. In comparison, Spirit Airlines’ unit revenues fell 9.6% in 2016 and 12.8% in 2015.

Legacy players’ matching fares

One of the main reasons for the fall in Spirit Airlines’ unit revenue is legacy players like Delta Air Lines (DAL) and American Airlines (AAL) matching low-cost carrier fares in order to fill seats. With United Continental becoming more aggressive in the price matching strategy, Frontier Airlines might see more unit revenue erosion in the next two years. United Continental shares Frontier Airlines’ major hub—Denver.

Investors can gain exposure to airlines by investing in the SPDR S&P Transportation ETF (XTN). XTN invests ~17% of its holdings in airline stocks.