Brokerages in 2018: What to Expect

The final week of the second quarter might help brokerages, primarily because of higher client participation.

July 2 2018, Updated 12:35 p.m. ET

Can volatility improve second-quarter numbers?

Before President Trump’s announcement that Chinese investments in US technology companies would be restricted, it was expected that sequentially, brokerages would be generating lower trading revenues in the second quarter. But after the announcement, the Dow Jones Industrial Average (DIA) saw a sharp correction. And with the announcement, fears over trade wars increased.

The final week of the second quarter might help brokerages, primarily because of higher client participation. But since it came at the end of the quarter, the effect could more likely be felt in the third quarter. In the first quarter, higher volatility helped brokerages. Moving forward, brokerages are expected to see more volatility since China could also announce measures against the United States.

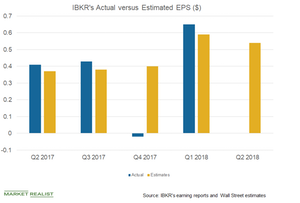

EPS in the second quarter

In the second quarter, Charles Schwab (SCHW) is expected to report EPS of $0.58, which is higher than the first quarter. E*TRADE Financial (ETFC) is expected to report EPS of $0.88, which is the same as the first quarter. Interactive Brokers Group (IBKR) is expected to report EPS of $0.54, which is lower than the first quarter, and TD Ameritrade Holding (AMTD) is expected to post EPS of $0.80, which is higher than the first quarter. In the second quarter, brokerages are expected to see less client participation sequentially.

In 2018, volatility is expected to rise as trade wars escalate, which could help brokerages’ trading revenues. In addition, they might have higher client participation in 2018 as investors possibly reshuffle their portfolio holdings to minimize their losses.