Dow Chemical’s Latest Valuations Post 1Q17 Earnings

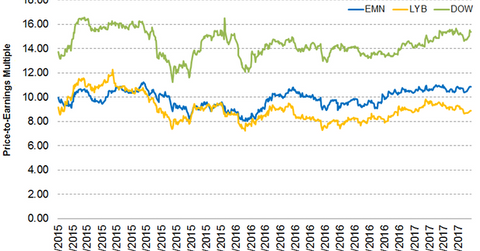

As of April 27, 2017, Dow Chemical (DOW) was trading at a one-year forward PE ratio of 15.4x, compared to Eastman Chemical (EMN) and LyondellBasell (LYB) at 10.9x and 8.9x, respectively.

May 2 2017, Updated 10:36 a.m. ET

Forward PE ratio

The forward PE (price-to-earnings) ratio is a relative valuation method that considers a company’s future earnings. As of April 27, 2017, Dow Chemical (DOW) was trading at a one-year forward PE ratio of 15.4x, compared to Eastman Chemical (EMN) and LyondellBasell (LYB) at 10.9x and 8.9x, respectively.

The forward PE ratio tells how much investors are paying for the stock per dollar of expected earnings in the next 12 months. It’s one of the most popular valuation tools and helps investors compare two or more companies that operate in the same industry. It checks which stock is overvalued or undervalued.

Dow Chemical trades at a premium

Currently, Dow Chemical is trading at a premium compared to its peers Eastman Chemical and LyondellBasell. DOW posted better-than-expected 1Q17 earnings due to organic growth and the continued integration of the Corning (GLW) business. After a two-year fall in DOW’s revenue, analysts expect the company’s 2017 revenue to rise to $52.9 billion in 2017. On the other hand, revenues for EMN and LYB have been struggling to grow their revenues.

Synergies from the Corning integration are expected to be more visible in 2017, which could lead to better earnings. Conditional approval from the European Commission for the merger of Dow Chemical and DuPont is expected to eventually bring in approximately $3.0 billion in synergies. Analysts expect Dow Chemical to post EPS (earnings per share) of $4.10 in 2017 and 4.40 in 2018. With EPS rising year-over-year, it appears that investors are willing to pay a premium over DOW’s peers.

You can hold Dow Chemical indirectly by investing in the Vanguard Materials ETF (VAW). VAW has invested 8.4% of its portfolio in Dow Chemical as of April 27, 2017.