Analysts’ Price Target and Recommendations for FMC Corporation

Like Monsanto (MON), FMC Corporation (FMC) is in the business of crop protection products. The majority of FMC’s sales come from its Agricultural Solutions segment.

Dec. 4 2020, Updated 10:43 a.m. ET

FMC Corporation

Like Monsanto (MON), FMC Corporation (FMC) is in the business of crop protection products. The majority of FMC’s sales come from its Agricultural Solutions segment, which includes crop protection products such as herbicides, insecticides, and fungicides.

FMC Corporation released its most recent quarterly earnings on May 3, 2017. It reported earnings per share (or EPS) of $0.43, missing analysts’ consensus EPS estimate of $0.53.

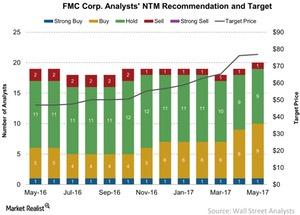

Let’s take a look at how analysts’ recommendations for the stock have changed in May 2017.

Recommendations

On May 10, one analyst had a “strong buy” recommendation on FMC, unchanged month-over-month. Nine analysts had “buy” recommendations on the stock, a rise of one analyst month-over-month.

Nine analysts had “hold” recommendations, and one analyst had a “sell” recommendation on the stock for the next 12 months. No analysts had “strong sell” recommendations on the stock, similar to its fertilizer peers (MOO) CF Industries (CF) and PotashCorp (POT).

Price target

Analysts’ price target for FMC has inched up slightly month-over-month. On May 10, the stock’s consensus price target stood at $76.9 per share, up from $76.2 per share. On May 10, the stock closed at $74.09, reflecting a potential ~3.9% upside over the next 12 months.

Next, we’ll discuss The Scotts Miracle-Gro Company.