Analysts Might Take a Fresh Look at U.S. Steel Corporation

U.S. Steel Corporation will release its 1Q17 earnings on April 24 after the market closes. The company’s earnings conference call will be on April 25.

April 11 2017, Updated 9:06 a.m. ET

1Q17 earnings release

U.S. Steel Corporation’s (X) 1Q17 earnings release is slated for April 24 after the market closes. The company’s earnings conference call will be on April 25. In this part, we’ll see how analysts rate U.S. Steel Corporation before to its 1Q17 earnings. We’ll see if analysts might upgrade U.S. Steel Corporation after its 1Q17 earnings.

Consensus estimates

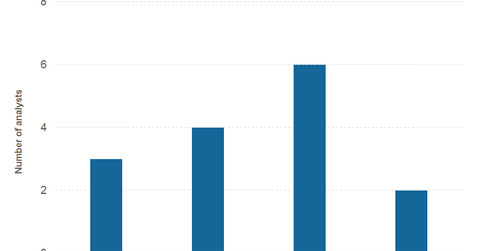

According to consensus estimates compiled by Thomson Reuters, U.S. Steel Corporation has a mean one-year price target of $38.46—13.5% upside over its closing prices on April 7, 2017. Of the 15 analysts surveyed by Thomson Reuters, seven recommended U.S. Steel Corporation stock as a “buy” or some equivalent, while two recommended a “sell” or some equivalent on the stock. It’s important to note that 40% of the analysts recommended a “hold” on the stock. Looking at other steelmakers (MT), AK Steel (AKS) and Nucor (NUE) received “hold” recommendations from 77% and 27% of the analysts, respectively.

Upgrades post 4Q16 earnings

Some analysts upgraded U.S. Steel Corporation after its 4Q16 earnings release. J.P. Morgan raised U.S. Steel Corporation’s one-year price target from $37 to $39. Bank of America also raised its rating on U.S. Steel Corporation from “neutral” to “buy.” The most noteworthy upgrade was from Argus. The brokerage downgraded the stock two months before its 4Q16 earnings.

U.S. Steel Corporation managed to beat its 4Q16 earnings by a wide margin. The company’s fiscal 2017 EBITDA (earnings before interest, tax, depreciation, and amortization) guidance impressed markets (MDY) (MID-INDEX).

Can U.S. Steel Corporation see more upgrades after its 1Q17 earnings release? We’ll discuss this more in the next part.