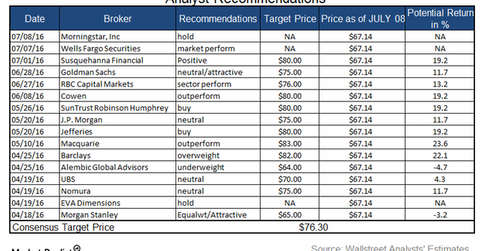

Analysts’ Ratings for Celanese before Its 2Q16 Earnings Release

On July 12, 2016, Celanese’s (CE) consensus 12-month target price was $76.30, indicating a return potential of 11.3% from that day’s closing price of $68.57.

July 14 2016, Published 3:56 p.m. ET

Analysts’ recommendations

On July 12, 2016, Celanese’s (CE) consensus 12-month target price was $76.30, indicating a return potential of 11.3% from that day’s closing price of $68.57.

Of the 16 brokerage firms tracking this stock, 50% of the brokers recommended the stock as a “buy,” 44% of the brokers recommended the stock as a “hold,” and 6% of the brokers recommended the stock as a “sell.”

Key recommendations for Celanese

A variety of brokerage firms and investment banks revised their target prices on Celanese after the company announced its 1Q16 results on April 18, 2016.

On June 8, Cowen and Company (COWN) gave an “outperform” rating to CE with a price target of $80.00. This implies a 12-month potential return of 16.7% over the July 12 closing price of $68.57.

On April 18, Morgan Stanley (MS) gave an “equal weight/attractive” rating to CE with a one-year price target of $65.00. This implies a return of -5.2% over the July 12 closing price of $68.57.

On April 12, Barclays (BCS) rated Celanese as “overweight” with a 12-month target price of $82.00, implying a potential one-year return of 19.6% over its July 12 price of $68.57.

On May 20, Jefferies gave a “buy” rating with a target price of $80.00. This implies a 12-month potential return of 16.7% over the July 12 closing price of $68.57.

Investors can invest in the iShares Russell Mid-Cap Value ETF (IWS) to indirectly invest in Celanese. On July 12, 2016, the fund invested 0.3% of its total holdings in Celanese.

In the next part, we’ll discuss on Celanese’s net profit margins and earnings per share (or EPS) estimates.