Why Walmart Is Investing Heavily in E-Commerce

If we look at the recent performance of the company, Walmart’s US (SPY) segment has benefited from the company’s e-commerce initiatives.

Nov. 20 2020, Updated 4:33 p.m. ET

A meaningful contribution

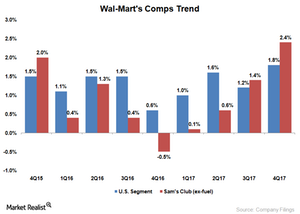

In a recent Market Realist series on Wal-Mart Stores (WMT), What’s in Store for Walmart in Fiscal 2018, we discussed why the company’s online sales are vital for its growth. The chart below reflects the company’s comparable-store-sales, or comps, trend for two of its major segments: the US and Sam’s Club.

If we look at the recent performance of the company, Walmart’s US (SPY) segment has benefited from the company’s e-commerce initiatives, which contributed about 40 basis points to the company’s sales. In the meantime, e-commerce sales added about 80 basis points to Sam’s Club’s comps during fiscal 4Q17 (ended January 31, 2017).

Walmart has been witnessing stellar growth at its e-commerce division and has been benefiting widely from the company’s strategic investments aimed at creating an omnichannel presence, which means offering a multichannel shopping experience to its customers.

Walmart’s global online sales rose 15.5% on a constant currency basis in fiscal 4Q17, while its US segment’s online sales jumped 29.0%. By comparison, the growth rate in global online sales in fiscal 4Q17 was way better than the 8.0% growth Walmart reported during fiscal 4Q16. However, it did decelerate from the 20.6% growth it witnessed in its fiscal 3Q17 online sales.

By comparison, Walmart rival Target (TGT) also posted strong digital sales numbers. During fiscal 4Q16, Target’s comparable digital sales shot up by 34%, adding about 1.8% points to its comps.

Walmart’s recent e-commerce initiatives

Walmart plans to continue investing into its e-commerce business to boost sales growth as the segment gains traction. The company has already made a series of acquisitions to strengthen its position in the recent past, including Jet.com, ShoeBuy, Moosejaw, and Hayneedle.

The company has also expanded its online grocery offerings, introduced store pickup and direct-to-home offerings, invested in China’s JD.com (JD), started a free two-day delivery on orders exceeding $35, and began offering the scan-and-go app at Sam’s Club—all as parts of its e-commerce initiatives. These initiatives should continue to help Walmart generate strong online sales going forward.

Notably, Walmart is now the second-largest online retailer in the US by revenue. It’s also among the top three online retailers in terms of traffic, and its Walmart app remains one among the top three apps in retail.

ETF investors looking for indirect exposure to Walmart might consider ETFs like the VanEck Vectors Retail ETF (RTH), which invests about 6.2% of the portfolio holdings in Walmart.

For more updates on Walmart and its peers, visit Market Realist’s Mass Merchandisers page.