How Japan’s Fiscal Policies Can Help Achieve Its Economic Goals

Prime Minister Abe’s administration initially achieved coordination between the Bank of Japan’s QQE and fiscal stimulus.

March 6 2017, Updated 10:36 a.m. ET

Fiscal measures helped economic growth

The government of Japan (EWJ) (JPMV) (DXJ) has used three types of policies to achieve economic growth—monetary, fiscal, and structural. Through these policies, the government of Japan aims to achieve three important goals:

- 3% nominal growth

- 2% inflation

- a primary budget surplus

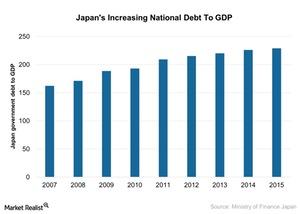

This monetary policy has been unsuccessful to get the economy out of the liquidity trap with the effective lower bound on the monetary policy rates. The lower interest rate and the fiscal stimulus led to a rapid increase in the public debt-to-GDP ratio.

Prime Minister Abe’s administration initially achieved coordination between the Bank of Japan’s QQE[1. Quantitative and Qualitative Monetary Easing] and fiscal stimulus. The government of Japan was able to narrow the output gap, reversed undue yen appreciation, and pulled inflation into positive territory.

However, the consumption tax hike in 2014 stalled the recovery and progress as the reflationary environment returned to the deflationary zone. Japan’s fiscal stance also turned out to be contractionary, with the uncertain nature of its fiscal policy with yearly sudden supplementary budget changes.

According to the IMF report, the Ministry of Finance has been increasingly concerned about the effectiveness of fiscal stimulus and the rising debt-to-GDP ratio. We can see in the chart above that the ratio of Japan’s national debt to its GDP is increasing every year.

So far, the fiscal stimuli have supported domestic demand, particularly through public investment, and helped avoid a deep deflationary spiral. The government’s net debt increased over 50% in the last decade. Over 95% is held domestically by Japanese institutions and households.

Impact of QQE

The Bank of Japan’s asset purchase program to some extent has been able to support the asset prices but has affected the profitability of banks. In the low interest rate environment, banks borrow at short-term rates to lend out at long-term rates.

The returns for the insurance and pension products are also under pressure as these products hold long-dated government bonds whose yields are down sharply due to the negative interest rate environment. Some of the Japanese banks to watch include Sumitomo Mitsui Financial Group (SMFG), Resona Holdings, Mizuho Financial (MFG), and Nomura Holdings (NMR).

In the next article, we’ll look at the performance of the Japanese stock market amid the deflationary environment.