Is Intel Taking a Huge Risk by Acquiring Mobileye?

The key risk Intel faces with the Mobileye acquisition is that Mobileye could fail to create an autonomous driving solution in time.

March 20 2017, Updated 10:36 a.m. ET

History of the Mobileye-Tesla partnership

In the previous part of this series, we saw that Intel (INTC) is acquiring Mobileye (MBLY) to reach out to the automotive market and provide an end-to-end autonomous driving solution. However, Mobileye has a history with Tesla (TSLA), which resulted in the automaker switching to Nvidia (NVDA). Mobileye supplied vision systems for Tesla’s initial Autopilot system. But the partnership ended in the summer of 2016 after a driver was killed while operating a car with a Tesla Autopilot system.

Mobileye’s current driver assistance systems are good at traffic-aware cruise control, automatic emergency braking, and lane-keeping, only if the driver is vigilant and attends to the alerts provided by Mobileye’s systems. They’re not fully autonomous. But Tesla oversold it as an autopilot system, which caused an accident and the death of a driver.

Tesla is now running another autopilot system powered by Nvidia Drive PX 2, which doesn’t require a driver to be vigilant.

How close is Mobileye’s technology to being fully autonomous?

Mobileye’s technology is far from fully autonomous. Leading competitors in autonomous cars such as Google (GOOG), Nissan, and General Motors (GM) have developed their own solutions that add LiDAR (light detection and ranging) to several sensors, cameras, and radar to help the car drive safely without human interference. That’s a Level 5 automation.

Level 5 autonomous cars are currently being tested. But even in the testing mode, Mobileye technology is far behind Nvidia’s.

Key risk in the autonomous car market

The key risk Intel faces with the Mobileye acquisition is that Mobileye could fail to create an autonomous driving solution before commercially available cars adopt competitors’ LiDAR-based solutions. Once these solutions go mainstream, Mobileye’s current driver-assistance systems would become obsolete and would only sell in the low-end market where growth opportunities are limited. If that happens, the $15.3 billion acquisition could be a waste of money.

In addition, Mobileye isn’t providing any leading position to Intel in the automotive market like NXP Semiconductors is providing Qualcomm.

Will the merger allow Intel to compete with Nvidia?

Mobileye may not offer Intel a fully autonomous car platform, but it might offer ASICs (application-specific integrated circuits) for autonomous cars. But keep in mind that Mobileye’s EyeQ processor isn’t even close to the performance of Nvidia’s Drive PX 2 system. While Mobileye’s future EyeQ 4 and 5 are expected to deliver performances of 2.5 and 15.0 teraflops, Nvidia’s current Drive PX 2 delivers a performance of 21.0 teraflops.

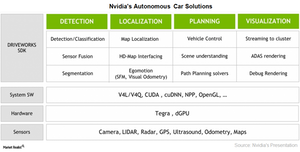

In addition, Nvidia goes beyond hardware and delivers a complete solution packed with hardware, software, and sensors to develop a fully autonomous car platform. Intel will have to go a long way to come close to Nvidia in the autonomous car market.