Could Laggards Come Out as Winners?

As with most timeframes in the market, the laggards are a mix of surprising and obvious names (in hindsight, of course). This October, they stand out a little more than usual since so many asset classes are up this year.

Oct. 31 2017, Updated 1:05 p.m. ET

Direxion

Zombie assets hope to return from the dead

As with most timeframes in the market, the laggards are a mix of surprising and obvious names (in hindsight, of course). This October, they stand out a little more than usual since so many asset classes are up this year. But they’re also down for their own reasons—not different versions of the same reason. So check over your shoulder when you pass a graveyard to see if assets as varied as natural gas, gold miners, Treasurys, and Mexico can rise from the dead and turn investors’ fright to delight. In any case, Direxion can help investors achieve their goals with a range of leveraged ETF products.

Risks:

An investor should consider the investment objectives, risks, charges, and expenses of Shares carefully before investing. The prospectus and summary prospectus contain this and other information about Shares. To obtain a prospectus or summary prospectus please visit www.direxioninvestments.com/regulatory-documents. The prospectus and summary prospectus should be read carefully before investing.

There is no guarantee that the funds will achieve their objectives. The Leveraged and Inverse ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking Daily leveraged investment results and intend to actively monitor and manage their investments. Investing in the Funds may be more volatile than investing in broadly diversified funds. The use of leverage by a fund means the Funds are riskier than alternatives which do not use leverage.

Direxion Shares Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Counterparty Risk, Intra-Day Investment Risk, risks specific to investment in securities of a Fund’s underlying index, for the Bull Funds, Daily Index Correlation Risk and Other Investment Companies (including ETFs) Risk, and for the Bear Funds, Daily Inverse Index Correlation Risk and risks related to Shorting and Cash Transactions. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

Distributor: Foreside Funds Services, LLC.

Market Realist

Dynamic environment needs dynamic approach

As we discussed in earlier parts of this series, though broader markets are up globally, there are pockets of assets that are declining and providing subdued returns to investors. While gold (NUGT)(JNUG) is up this year, many gold miners are besieged by internal issues that have depressed their fundamentals and overall returns. Similarly, natural gas (GASL) prices are down over 20% this year, mainly affected by unfavorable weather forecasts apart from the usual factor of demand and supply mismatch.

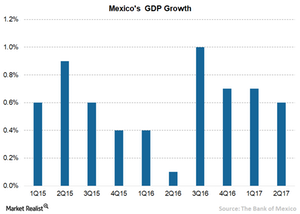

Treasury yields (TYO)(TYD), after falling up to September, have started rising again on the renewed hope of higher economic growth and expectations of higher interest rates. Similarly, as the chart above shows, Mexico’s (MEXX) economic growth isn’t picking up as expected and is further aggravated by concerns relating to a possible failure of NAFTA talks. Overall, these laggards are expected to remain depressed in the near future, though any change in the situation could mean bumper returns to investors taking on higher risk.

In today’s dynamic environment, investors need to act swiftly and decisively to explore new opportunities. They must keep up with new developments while assessing the impact of different variables on asset classes. Alternatively, they can explore leveraged and diverse ETFs available in the market.