How Micron Technology Could Benefit from an Early Transition to 3D NAND

Micron Technology’s chief financial officer, Ernie Maddock, stated that a company transitioning to 3D NAND would see negative bit growth in the first half as it puts planar capacity offline.

March 28 2017, Updated 9:05 a.m. ET

Micron’s NAND supply outlook for 2017

Micron Technology (MU) is investing in advanced technology to become the lowest-cost NAND supplier. The company expects to grow its NAND bit output by more than 60% in 2017 and gain a significant market share.

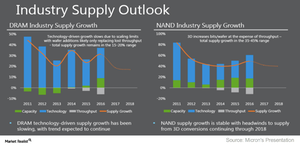

Micron Technology expects the NAND industry’s bit output to grow between 40%–45% in 2017, even though the top four NAND manufacturers, which account for over 80% of global bit output, are still transitioning to 3D NAND.

The process to transition to 3D NAND

The process of transitioning from planar to 3D NAND involves stopping the production completely and then replacing the old equipment with new equipment. The 3D NAND is material intensive and requires high aspect ratio etching and chemical vapor deposition equipment, which occupies a lot of space. This process could almost halve the wafer production capacity.

Micron Technology’s chief financial officer, Ernie Maddock, stated that a company transitioning to 3D NAND would see negative bit growth in the first half as it puts planar capacity offline. Then, it would see positive bit growth in the second half as it brings 3D NAND into production. Hence, the company’s net overall output for a year could be zero to 2%.

When Micron Technology transitioned to 3D NAND in 2016, its bit output growth was lower than 10%. Samsung (SSNLF) expects its NAND bit output growth to reach ~30% in 2017.

Industry transitions to 3D NAND

Due to no output growth for a year, many NAND makers delayed the transition from the high gross margin planar NAND to 3D NAND. However, Micron and Intel (INTC) were far behind competitors in the planar NAND, leaving them with no option but to transition to 3D NAND earlier than the rest.

According to Maddock, less than 30% of NAND industry output has transitioned to 3D NAND. Samsung is still transitioning, and SK Hynix and Toshiba (TOSBF)/Western Digital (WDC) haven’t started the transition to 3D NAND. Moreover, the current financial troubles at Toshiba could also delay its 3D NAND transition, which we’ll explore in the next article.

Every company’s transitioning speed and yield may differ. Looking at the current state of 3D NAND conversion, there is a possibility that the industry could miss the expected target NAND bit output growth of 40%–45% in 2017. This indicates that the undersupply situation could persist in 2017 and probably in 2018, resulting in higher prices.

In the long term, the situation may change as competitors’ fabs come online. If Micron Technology does not build more fabs, its bit share gains could dissipate in 2019 and 2020.