How Did Mining Stocks Correlate with Gold in March 2017?

Yamana’s correlation with gold has increased from a three-year correlation of ~0.74 to a one-year correlation of ~0.80.

March 31 2017, Updated 6:59 p.m. ET

Miners’ correlations with precious metals

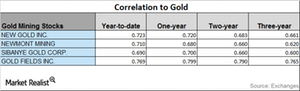

Amid the turbulence in the market, precious metals saw temporary increases as Trump’s healthcare bill failed. However, there was a positive impact on mining stocks. Earlier, mining stocks were facing losses amid rising interest rates. For investors interested in mining stocks, it’s crucial to understand which stocks are closely tied to precious metals and which aren’t.

Stocks with higher correlations to precious metals will likely be even more affected by the global indicators that influence the precious metals themselves.

Precious-metal-based funds such as the Physical Swiss Gold Shares (SGOL) and the Physical Silver Shares (SIVR) have also seen significant correlations with their respective precious metals. These two funds closely track the performance of each of their metals and have risen 8.9% and 14.2%, respectively, during the past five trading days.

Now, let’s take a look at Randgold Resources (GOLD), Yamana Gold (AUY), Pan American Silver (PAAS), and Coeur Mining (CDE).

Correlation trends

Among the four miners mentioned above, Pan American has the lowest correlation with gold, and Yamana has the highest correlation with gold.

Over the past three years, only Yamana Gold has witnessed an upward trending correlation to gold, while the other three showed a mix of upward-downward movement in their correlation to gold. Studying the upward and downward trends is important, as the price change predictability can be affected as precious metals prices rise and fall.

Yamana’s correlation with gold has increased from a three-year correlation of ~0.74 to a one-year correlation of ~0.80. A correlation of ~0.80 means that ~80.0% of the time, Yamana has moved in the same direction as gold in the last year.