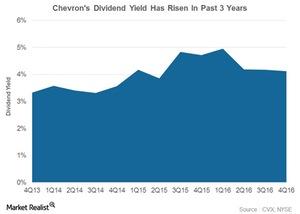

How Chevron’s Dividend Yield Has Trended

Chevron’s dividend yield Chevron (CVX) has consistently given returns to shareholders in the form of dividends. Therefore, we have evaluated its dividend yields. Yield is calculated as a ratio of the annualized dividend to stock price. Chevron’s dividend yield rose from 3.3% in 4Q13 to 4.1% in 4Q16, due to a dividend increase coupled with […]

March 15 2017, Updated 7:36 a.m. ET

Chevron’s dividend yield

Chevron (CVX) has consistently given returns to shareholders in the form of dividends. Therefore, we have evaluated its dividend yields. Yield is calculated as a ratio of the annualized dividend to stock price. Chevron’s dividend yield rose from 3.3% in 4Q13 to 4.1% in 4Q16, due to a dividend increase coupled with a fall in its stock price.

Peers’ dividend yield

During the same period, Royal Dutch Shell’s (RDS.A) dividend yield rose sharply from 5.5% to 7.5%, whereas BP’s (BP) dividend yield rose from 5.4% to 6.1%. ExxonMobil’s (XOM) dividend yield rose from 2.8% in 4Q13 to 3.6% in 4Q16. If you’re looking for exposure to high-dividend stocks, you could consider the iShares Core High Dividend ETF (HDV), which also has ~15% exposure to energy sector stocks.