How Canadian Pacific’s Intermodal Traffic Trended

Canadian Pacific’s (CP) intermodal volumes have been rising for the past few weeks.

Nov. 20 2020, Updated 5:12 p.m. ET

Canadian Pacific’s intermodal traffic

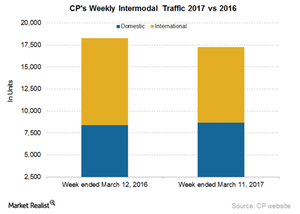

Canadian Pacific’s (CP) intermodal volumes have been rising for the past few weeks. In the week ended March 11, 2017, CP reported a 5.5% slump in overall intermodal traffic. However, domestic container and trailer traffic was an exception with a marginal rise of 3.6% to about 9,000 units.

However, there was a 13.2% YoY (year-over-year) drop in CP’s international intermodal business. Volumes contracted to ~8,500 containers and trailers from around 10,000 last year.

In the week ended March 11, 2017, CP’s intermodal traffic fell, which was in contrast to the overall rise that Canadian railroads posted.

Why intermodal matters for CP

Increased truck capacity in CP’s short-haul lane will most likely result in tough competition in the domestic intermodal space going forward. Since the company gets most of its domestic intermodal business from Canada, it would be heavily affected by growth in the Canadian economy.

The company’s international intermodal business consists of containerized traffic between the ports of Vancouver, Montreal, and New York. CP’s international intermodal growth is tied to capacity growth at these ports. Retail demand and the pace of transpacific trade with China also have a bearing on international intermodal volumes of other class I rail carriers (XLI).

Railroads’ intermodal segments compete with major US trucking companies such as J.B. Hunt Transport Services (JBHT), Old Dominion Freight Lines (ODFL), Swift Transportation (SWFT), and XPO Logistics (XPO).

Investments

The ProShares Ultra S&P 500 ETF (SSO) invests ~7.6% in the industrial sector, which includes transportation and logistics. If you want to compare this week’s freight volume data with the previous week’s, check out Market Realist’s Week Ended March 4: Was US Rail Traffic on the Right Track?

For ongoing updates on major US railroad stocks, keep checking in with Market Realist’s Railroads page.