Analysts’ Latest Recommendations for Air Products & Chemicals

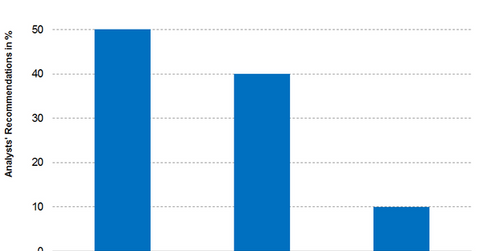

As of March 29, 2017, 20 brokerage firms were actively tracking Air Products & Chemicals (APD). About 50.0% of them recommended a “buy” for the stock.

March 31 2017, Updated 9:06 a.m. ET

What analysts think about Air Products & Chemicals

As of March 29, 2017, 20 brokerage firms were actively tracking Air Products & Chemicals (APD) stock. About 50.0% of them have recommended a “buy” for the stock, and 40.0% have recommended a “hold.” The remaining 10.0% have recommended a “sell.”

Analysts’ consensus indicates a 12-month target price of $150 for APD. That implies a return potential of 9.7% from its closing price of $136.78 on March 29, 2017.

Most analysts recommend a ‘buy’

Although APD posted lower-than-expected 1Q17 fiscal earnings, in the past three to four months it has managed to land several new businesses. They could boost its future revenues and earnings. These factors may have influenced half of the analysts to recommend a “buy” for the stock.

Recommendations and targets

Below are some of the recommended target prices for Air Products & Chemicals from well known brokerage firms:

- On February 13, 2017, Barclays (BCS) rated Air Products & Chemicals an “overweight” with a target price of $160. That implies a 12-month potential return of 17.0% from its March 29, 2017, closing price of $136.78.

- On January 30, 2017, JPMorgan Chase (JPM) gave Air Products & Chemicals a target price of $150. That implies a 12-month potential return of 9.7% from its March 29, 2017, closing price of $136.78.

- On January 30, 2017, Credit Suisse (CS) gave Air Products & Chemicals a target price of $151. That implies a 12-month potential return of 10.4% from its March 29, 2017, closing price of $136.78.

You can indirectly hold Air Products & Chemicals by investing in the Vanguard Materials ETF (VAW), which has invested 3.5% of its portfolio in APD as of March 29, 2017.

In the next part of this series, we’ll look at the latest valuations for Air Products & Chemicals.