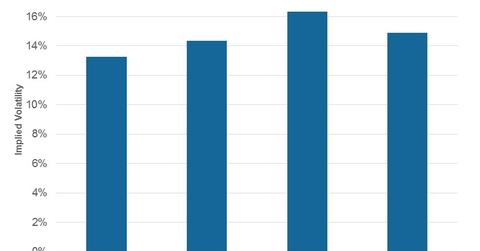

Where Do Implied Volatilities in Integrated Energy Stocks Stand?

Implied volatility in Royal Dutch Shell (RDS.A) currently stands at 16%, which is the highest compared to peers ExxonMobil (XOM), Chevron (CVX), and BP (BP).

Feb. 17 2017, Updated 7:36 a.m. ET

Implied volatilities in integrated energy stocks

Implied volatility in Royal Dutch Shell (RDS.A) currently stands at 16%, which is the highest compared to peers ExxonMobil (XOM), Chevron (CVX), and BP (BP). On the other hand, XOM has the lowest implied volatility at 13%.

CVX and BP have implied volatilities of 14% and 15%, respectively. For exposure to integrated energy stocks, investors can consider the iShares North American Natural Resources ETF (IGE). The ETF has ~21% exposure to the sector.

Move on to the next part to know how integrated energy stocks’ valuations compare to last year’s averages.