Why Domino’s Dividend Policy Is Important

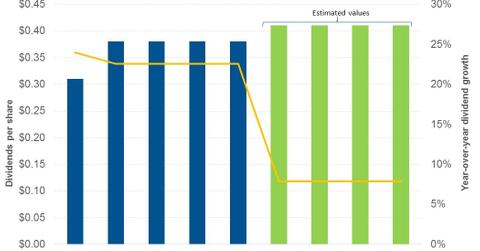

In 2016, Domino’s Pizza (DPZ) paid dividends of $1.52—growth of 22.5% from $1.24 in 2015. In 2017, analysts expect its dividends to rise 7.9% to $1.64.

Feb. 22 2017, Updated 9:06 a.m. ET

2016 dividends

Dividends help smooth out the return volatility for shareholders, which is important for cyclical companies—including the restaurant sector. In 2016, Domino’s Pizza (DPZ) paid dividends of $1.52—growth of 22.5% from $1.24 in 2015. In 2017, analysts expect its dividends to rise 7.9% to $1.64.

Dividend payout and yields

In 2016, Domino’s paid dividends of $1.52 at a payout ratio of 35.8% and at a dividend yield of 0.81%. The company’s one-year forward dividend yield is hovering around 0.65%—compared to 2.3% for Yum! Brands (YUM) and 0.73% for Papa John’s (PZZA) as of February 17, 2017.

Capital allocation

In addition to paying dividends, Domino’s rewards its shareholders with share repurchases or buybacks. In the first three quarters of 2016, the company repurchased 2.25 million shares worth ~$283.9 million. By the end of 3Q16, the company had ~$165.5 million under its share repurchase program.

You can also gain exposure to Domino’s by investing in the iShares Core S&P Mid-Cap ETF (IJH). IJH invested 0.53% of its holding in Domino’s. IJH also invested in restaurant stocks such as Jack in the Box (JACK) and Papa John’s.

Next, we’ll look at Domino’s valuation multiple before its 4Q16 earnings.