Wall Street Sees a 1% Upside on VFC Stock

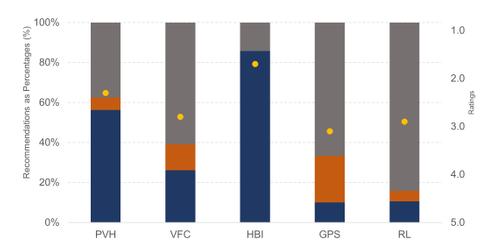

VFC is covered by 23 Wall Street analysts who have a neutral view on the company. Plus, 26% of these analysts recommended a “buy,” 61% recommended a “hold,” and 13% recommended a “sell” on the stock.

Feb. 28 2017, Updated 9:05 a.m. ET

Wall Street recommendations on VFC

In this final part of the series, we’ll look at Wall Street’s recommendations for VF Corporation (VFC). VFC is covered by 23 Wall Street analysts who have a neutral view on the company. Plus, 26% of these analysts recommended a “buy,” 61% recommended a “hold,” and 13% recommended a “sell” on the stock. In comparison, 86% analysts suggested buying Hanesbrands (HBI), and 56% recommended buying PVH Corp (PVH).

Recent analyst actions

VFC was downgraded by a couple of research firms in 2017. Piper Jaffray lowered the company from an “overweight” rating to a “neutral” rating on January 8.

On February 2, Goldman Sachs downgraded VFC to “neutral” from “conviction buy.” On February 7, Evercore ISI downgraded VFC from a “buy” to a “hold” rating.

While talking about the reason behind the downgrade, Goldman Sachs analyst Lindsay Drucker Mann said that VFC “remains acutely exposed to structural pressures facing their largest retail partners including declining store traffic, excess promotions, and internet competition.”

Mann added, “VFC’s formerly high-growth segment Outdoor & Action has slowed from its double-digit historical CAGR to low-single digits in recent quarters.”

Comparing analyst ratings

Wall Street analysts have jointly rated VFC a 2.8 on a scale of 1 (strong buy) to 5 (sell). The company has a better rating than peers Ralph Lauren (RL) and Michael Kors (KORS), which are rated 2.9 and 3.0, respectively. However, HBI and PVH are rated 1.7 and 2.3, respectively.

Target price

VFC is trading at $52.68, ~27% below its 52-week high price. Wall Street has assigned an average price target of $53.36 for the company, which indicates a potential upside of just 1% over the next 12 months.

Respectively, PVH, HBI, and KORS have upside potentials of 24%, 31%, and 9%, which are currently better than VFC.

Investors who want exposure to VFC can consider the First Trust Rising Dividend Achievers ETF (RDVY), which invests ~1.9% of its portfolio in VFC.