How the Removal of Dodd-Frank Could Affect Banks

While the Dodd-Frank Act was passed to avoid another financial crisis, it has crippled banks’ profitabilities over the years due to higher capital requirements.

Feb. 27 2017, Updated 2:06 p.m. ET

Direxion

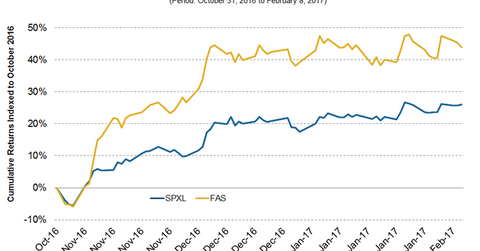

Easing regulations has been another pillar of the Trump campaign and another way to rev up growth. Lower regulations should clear any costly or growth-inhibiting roadblocks. One of Trump’s early executive orders was to direct the (new) Treasury Secretary to review the 2010 Dodd-Frank financial oversight law. The perception alone that financial institutions will be less burdened by regulations has been enough for investors. Since the election, financials have massively outperformed the market on the hopes that a revamping of regulations may allow these companies to grow much faster and deploy their massive reserves in way that benefits them and the economy.

Market Realist

The Dodd-Frank Reform became a law on July 21, 2010. It came in the aftermath of the financial crisis. However, the capital restrictions have had a negative impact on banks’ profitabilities.

According to data collected by the Federal Financial Institutions Examination Council, the return on equity fell from more than 15.0% for most of the 1990s and early 2000s to less than 10.0% after 2009. While the Dodd-Frank Act was passed to avoid another financial crisis, it has crippled banks’ profitabilities over the years due to higher capital requirements.

With Donald Trump likely to dismantle the regulation, financials (FAS) (KRE) have been outperforming the broader markets (SPXL), as you can see in the above graph.

There could be a downside, however. Since 2010, big banks have spent a lot to change the way they do business. The easing of regulations could cost them dearly to switch back.