Inside Ralph Lauren’s Fiscal 3Q17 Results

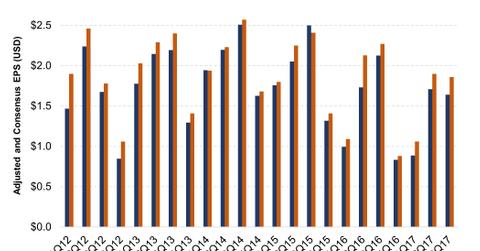

RL delivered better-than-expected earnings and in-line revenues, but its EPS fell 18% YoY to $1.86.

Feb. 6 2017, Updated 7:37 a.m. ET

Ralph Lauren’s fiscal 3Q17 results

Ralph Lauren (RL) reported results for its fiscal 3Q17 on Thursday, February 2, 2017. The results pertain to the period ended December 31, 2016.

The company delivered better-than-expected earnings and in-line revenues. Its EPS (earnings per share) fell 18% YoY (year-over-year) to $1.86. On average, analysts were expecting a 28% YoY fall to $1.64 per share.

RL’s total revenues fell 12% YoY to $1.7 billion—its seventh straight quarterly decline. Fiscal 3Q17 wholesale revenues were 26% lower YoY, primarily because of the strategic reduction in North American shipments, in an effort to reduce excess inventories and improve the quality of sales.

RL’s retail revenue fell 2%, and comparable store sales fell 5% on account of lower traffic and a fall in the average transaction size. Licensing revenues fell 4% in fiscal 3Q17.

A look at margins

RL’s gross profit margin improved by 140 basis points to 58.2%, driven by favorable channel and geographic shifts, reduced promotional activities, and other initiatives to improve the quality of sales.

However, the company’s operating expenses fell 7% as the company laid off employees and closed unprofitable stores as a part of its Way Forward plan.

As a result, adjusted operating margin expanded 40 basis points YoY in fiscal 3Q17. including the negative effect of currency exchange, the operating margin fell 90 basis points to 12.8%.

RL’s profitability as compared to peers

Ralph Lauren’s operating margin is among the lowest in the apparel and fashion industry. The company’s TTM (trailing-12-month) operating margin stands at 8%. By comparison, PVH Corporation (PVH), VF Corporation (VFC), Coach (COH), and Michael Kors (KORS) reported TTM operating margins of 10%, 12.6%, 15%, and 21.8%, respectively.

Notably, ETF investors looking to add exposure to Ralph Lauren can consider the iShares US Consumer Goods ETF (IYK), which has 0.2% of its total portfolio in the company.

Continue to the next part for a closer look of RL’s stock market performance.