Mining Stocks and Gold Prices: Reading the Correlation

It’s important to understand which mining stocks have overperformed and underperformed precious metals.

Feb. 27 2017, Published 12:22 p.m. ET

Mining stocks and gold

It’s important to understand which mining stocks have overperformed and underperformed precious metals. Precious metal prices have risen since their ten-month lows in December 2016. As a result, most mining stocks have also increased substantially since then.

Mining companies with high correlations to gold include Newmont Mining (NEM), Agnico-Eagle Mines (AEM), Primero Mining (PPP), and Silver Wheaton (SLW). These companies rose significantly YTD (year-to-date) in 2016, and 2017 started with a price revival.

Correlation trends

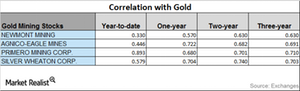

As you can see in the table above, Primero has the closest correlation to gold on a YTD basis among the four miners under review. Newmont is the least correlated with gold on a YTD basis.

All four miners have seen upward and downward movements in their correlation. Primero witnessed a downward movement in its correlation from three years to one year. Primero’s correlation fell from 0.71 three-year correlation to 0.68 one-year. The correlation of 0.68 suggests that about 68% of the time, Primero moved in the same direction as gold in the last year. Usually, a fall in gold leads to falling mining stock prices, and vice versa.

Gold’s relationships to Gold Fields and Pan American haven’t been stable, seeing upward-downward trends. Mining funds that have an apparent correlation to the fluctuations in precious metals include the Physical Swiss Gold Shares (SGOL) and the Physical Silver Shares (SIVR).