The Cycle Continues, but the Risks Are Rising

OppenheimerFunds In response to accusations of flip-flopping, John Maynard Keynes purportedly quipped, “When the facts change, I change my mind. What do you do, sir?” With 2017 in full swing, the facts have changed. Since the financial crisis, the global economy has been mired in a slow growth, disinflationary world. We argued that the weak […]

Feb. 23 2017, Updated 10:28 a.m. ET

OppenheimerFunds

In response to accusations of flip-flopping, John Maynard Keynes purportedly quipped, “When the facts change, I change my mind. What do you do, sir?” With 2017 in full swing, the facts have changed. Since the financial crisis, the global economy has been mired in a slow growth, disinflationary world. We argued that the weak economic environment would paradoxically continue to extend, rather than curtail, the cycle. Monetary policy in the developed world would remain accommodative and low rates would prove a modest tailwind to global economic activity.

What has changed? Americans voted for a path out of the economic “malaise.” The Trump administration seems ready to deliver fiscal stimulus, tax cuts, and the deregulation of select industries. This is now the biggest game in town, with apologies to the U.S. Federal Reserve (Fed).

The base case is that there is a good story to be told here. Fiscal stimulus—both in the form of targeted spending and tax cuts—could propel stronger global growth. Animal spirits are uplifted as the economy gathers momentum and inflation expectations rise. Therefore, investors may want to be purchasing short- over long-term bonds and senior loans over high yield. We would also favor value over growth stocks.

Alas, the risks to the outlook have now increased. Global growth may become too hot too quickly. The Fed could find itself behind the curve with regards to inflation and be forced to tighten policy too quickly. Higher interest rates could become a drag on this aging cycle. Fiscal stimulus could provide a near-term boost that then fades. Protectionist sentiment threatens. In short, the risk of an accident looms large, particularly with the U.S. economy already flying close to the ground. We are all Keynesians now. The base case calls for optimism, but the risks are climbing.

Market Realist

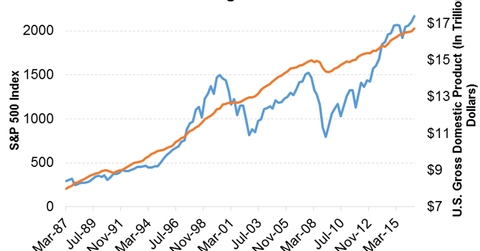

The above graph compares the S&P 500 (SPY) (IVV) index with the U.S. GDP over the past 30 years. It suggests that stocks (RWL) (RWJ) tend to follow the trajectory of the economy in the long term, while there could be aberrations in the short term.

One such aberration has been happening in the past few years, while monetary policy, not economic growth, has dictated the path of the S&P 500.

However, there’s only so much that monetary policy can do. The bull market (RDIV) is long in the tooth and faces many headwinds, including lofty valuations, a stronger dollar, and the possibility of higher interest rates.

That said, fiscal stimulus and tax cuts could stimulate economic growth. Corporate tax cuts could lead to higher earnings.

The downside in that scenario is that aggressive government spending coupled with tax cuts could lead to a higher fiscal deficit and increase the already high debt levels. How the new government will tackle this situation remains to be seen.