Synergies from the ON–Fairchild Semiconductor Merger

ON Semiconductor (ON) expects the Fairchild Semiconductor merger to bring in annual cost synergies of $225 million by 2019 compared with just $160 million in 2017.

Feb. 21 2017, Updated 2:35 p.m. ET

ON–Fairchild Semiconductor merger

On February 12, 2017, ON Semiconductor (ON) reported better-than-expected 4Q16 earnings that were driven by the integration of Fairchild Semiconductor. ON completed a $2.4 billion merger with Fairchild Semiconductor on September 19, 2016. ON’s 4Q16 earnings indicate that the company is realizing merger synergies faster than expected.

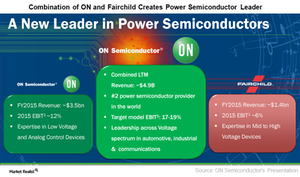

Fairchild merger makes ON a leader in power semiconductors

ON Semiconductor (ON) is a leader in low-voltage power management and analog control devices, and Fairchild is a leader in medium- and high-voltage power management solutions. The combined company would offer a broad portfolio of voltage products that serve the automotive, industrial, and communications markets.

The complementary nature of the two companies’ products makes the combined company a leader in power semiconductors, putting it among the world’s top ten non-memory semiconductor companies. The combined company would have annual revenues of $5 billion, which is more than ON’s target of $4 billion. The cost synergies and incremental profits could help ON achieve its target margins.

Cost synergies

ON Semiconductor (ON) expects the Fairchild Semiconductor merger to bring in annual cost synergies of $225 million by 2019 compared with just $160 million in 2017. The $75 million incremental synergies are expected to come after ON makes operational improvements and brings its production in house to leverage Fairchild’s manufacturing network. ON aims to bring production in house by the end of 2017 and start realizing the cost benefits in 2018.

The company also aims to complete the integration of ERP (enterprise resource planning) systems and combine the two companies’ research and development efforts by the end of 2017. This would bring savings in operating expenses and improve margins.

Revenue synergies

Both Fairchild Semiconductor and ON Semiconductor have little overlap in their products and customers, bringing several cross-selling opportunities. Moreover, the combined company would benefit from the two company’s diversified customer base. The combined company’s biggest customer would account for 4% of the company’s revenues.

The combined company would earn 75% of its revenues from the automotive, industrial, and communications markets. Even within these markets, it would be a dominant player in the fast-growing segments of ADAS (advanced driver assistance systems), vehicle electrification, automotive LED lighting, mobile charging solutions, and industrial motor control.

Like Nvidia (NVDA) and Cypress (CY), ON has increased its exposure in these fast-growing markets. This could help ON outperform the semiconductor industry, as NVDA and CY have outperformed the industry.

Next, we’ll look at ON’s revenues after the Fairchild Semiconductor acquisition. The SPDR S&P 500 ETF (SPY) has holdings in US equities listed in the S&P 500 Index, and it has 0.99% exposure to NVDA.