What Are Analysts’ Recommendations for Chemours?

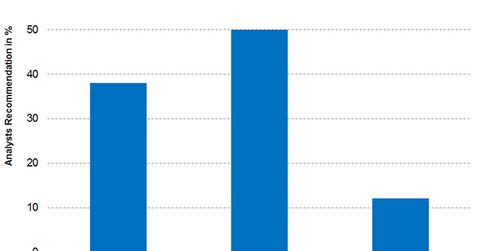

After Chemours’ 4Q16 earnings, 38.0% of the analysts recommended a “buy” for the stock, 50.0% recommended a “hold,” and 12.0% recommended a “sell.”

Feb. 20 2017, Updated 9:06 a.m. ET

Analysts’ recommendations

Before the 4Q16 earnings release, eight brokerage firms were actively tracking Chemours (CC) stock. About 25.0% of the analysts recommended a “buy” for the stock, while 63.0% of them recommended a “hold.” About 12.0% recommended a “sell.”

Recommendations after its 4Q16 earnings

Analysts’ recommendations changed after Chemours’ 4Q16 earnings. As of February 16, 2017, eight brokerage firms were actively tracking Chemours stock. About 38.0% of the analysts recommended a “buy” for the stock, while 50.0% of them recommended a “hold.” About 12.0% recommended a “sell.” Analysts recommended a 12-month target price for Chemours at $29.57. It indicates a potential return of -7.3% compared to the closing price of $31.9 as of February 16, 2017.

Recommendations and targets

Below are some recommended target prices for Chemours from some well-known brokerage firms:

- On February 16, 2017, Goldman Sachs (GS) rated Chemours as a “buy” with a target price of $42. It implies a 12-month return of 31.70% based on the closing price of $31.90 on February 16, 2017.

- On February 14, 2017, Jefferies provided Chemours with a target price of $35. It implies a 12-month return of 9.7% based on the closing price of $31.90 on February 16, 2017.

- On February 14, 2017, Citigroup (C) provided Chemours with a target price of $34. It implies a 12-month return of 6.6% based on the closing price of $31.90 on February 16, 2017.

You can indirectly hold Chemours by investing in the PowerShares DWA Basic Materials Momentum ETF (PYZ). PYZ invested 4.5% of its holdings in Chemours as of February 16, 2017. The fund’s top holdings include Cliffs Natural Resources (CLF) and Avery Dennison (AVY). They have weights of 4.8% and 3.6%, respectively.