What’s the Latest News on Apple?

Apple (AAPL) reported fiscal 4Q16 net sales of $46.9 billion, which represents a YoY (year-over-year) fall of 8.9% from its net sales of $51.5 billion in fiscal 4Q15.

Dec. 30 2016, Updated 10:37 a.m. ET

Price movement

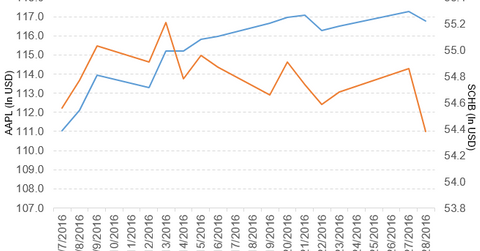

Apple (AAPL) has a market cap of $621.4 billion. It fell 0.43% to close at $116.76 per share on December 28, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -0.16%, 4.7%, and 13.4%, respectively, on the same day.

AAPL is trading 2.7% above its 20-day moving average, 3.6% above its 50-day moving average, and 11.0% above its 200-day moving average.

Related ETF and peers

The Schwab US Broad Market ETF (SCHB) invests 2.5% of its holdings in Apple. The YTD price movement of SCHB was 12.5% on December 28.

The market caps of Apple’s competitors are as follows:

Latest news on Apple

On December 28, 2016, Apple’s chief executive officer, Tim Cook, provided his views to CNBC. CNBC reported, “Cook declined to talk specifically on Apple’s outlook, but he said it has been a ‘great holiday’.”

Cook added that the company’s new wireless earbuds, AirPods, are “a runaway success.” When asked if more would come into stock, he said that Apple is “making them just as fast as we can.”

Apple’s performance in fiscal 4Q16

Apple (AAPL) reported fiscal 4Q16[1. quarter ended September 24, 2016] net sales of $46.9 billion, which represents a YoY (year-over-year) fall of 8.9% from its net sales of $51.5 billion in fiscal 4Q15. The company’s gross profit margin and operating margin narrowed 180 basis points and 310 basis points, respectively.

Its net income and EPS (earnings per share) fell to $9.0 billion and $1.67, respectively, in fiscal 4Q16, compared to $11.1 billion and $1.96, respectively, in fiscal 4Q15.

Fiscal 2016 results

In fiscal 2016, AAPL reported net sales of $215.6 billion, which represents a YoY fall of 7.7%. Its net income and EPS fell to $45.7 billion and $8.31, respectively, in fiscal 2016, compared to $53.4 billion and $9.22, respectively, in fiscal 2015.

AAPL’s cash and cash equivalents and inventories fell 2.8% and 8.7%, respectively, between fiscal 2015 and fiscal 2016. Its current ratio and debt-to-equity ratio rose to 1.4x and 1.5x, respectively, in fiscal 2016, compared to 1.1x and 1.4x, respectively, in fiscal 2015.