Well Cost Trends in the Permian Basin

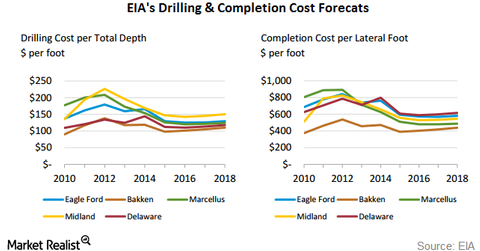

The EIA and IHS Global have revealed that the average well-drilling and completion costs in major US regions, including the Permian, will likely decline.

Jan. 26 2017, Updated 7:38 a.m. ET

Drilling and completion costs

In this series, we’ve already noted how the Permian Basin has been leading in the number of active rigs, as compared to other producing regions. Now let’s take a look at why.

The EIA (US Energy Information Agency) and IHS Global revealed in a March 2016 study that the average well drilling and completion costs in major producing regions in the US, including the Permian, would decline. The study on well cost trends was based on data from 2006 through 2015. Based on this data, the IHS released its forecast for 2016 through 2018.

IHS expects well costs to decline at the end of the study period (2018), as compared to 2012 levels, when they had peaked. This will be a result of the combination of reduced drilling activity and drilling efficiencies.

Delaware Basin

In reference to the Delaware basin, the IHS report stated: “Despite increasing EUR’s, the cost per Boe has grown nearly a dollar since longer laterals are being drilled with greater completion intensity. Under the new cost environment in 2015, it is expected that well design will continue to grow. This will provide even more production per well and at better economics than in the recent past.”

Midland Basin

In reference to the Midland Basin, the IHS report stated: “Future Midland development will focus on the core areas and increasing lateral lengths in those areas to maximize production. Cost per boe worsened going into 2014, but this will improve going forward as less risky well locations are drilled with better well designs.”

We should note that the Midland Basin and Delaware are sub-basins within the Permian Basin. Key Permian players include Apache (APA), Concho Resources (CXO), and Chevron (CVX).