Once Again, ExxonMobil Discovers Oil in Guyana

ExxonMobil (XOM) has found oil in the Payara-1 Well in the Stabroek Block, positioned 120 miles offshore Guyana. This is the company’s second discovery in the block.

Jan. 18 2017, Updated 3:35 p.m. ET

ExxonMobil discovers oil in Guyana

ExxonMobil (XOM) has found oil in the Payara-1 Well in the Stabroek Block, positioned 120 miles offshore Guyana. This is the company’s second discovery in the block. ExxonMobil is focusing on developing a robust upstream portfolio with growth opportunities.

Payara-1 Well drilling started on November 12, 2016. The well was drilled by Esso Exploration and Production Guyana Limited (or EEPGL), ExxonMobil’s affiliate. The company reached the well’s initial total depth on December 2, 2016. The well has ~95 feet of sandstone reservoir containing oil. The company is further evaluating the Payara-1 by drilling sidetracks and doing a well test. Once the data from these drillings are available, the well’s resources can be estimated.

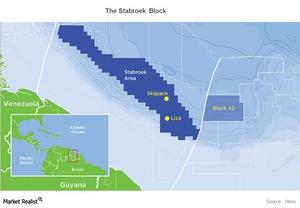

The Stabroek Block, which contains Payara-1, is operated by EEPGL, which also holds a 45% stake in it. The remaining stake is held by Hess Guyana Exploration at ~30% and CNOOC Nexen Petroleum Guyana Limited at ~25%.

Close to Payara-1, around ten miles away, the Liza field was discovered in the same block in May 2015. The field has 295 feet of sandstone reservoir containing oil. While appraisal drilling at Liza-3, Exxon found another reservoir, expected to hold ~100 million–150 million barrels of oil equivalent, right beneath the Liza field.

A word from management

Following the discovery, Steve Greenlee, president of ExxonMobil Exploration Company, stated, “These latest exploration successes are examples of ExxonMobil’s technological capabilities in ultra-deepwater environments, which will enable effective development of the resource for the benefit of the people of Guyana and our shareholders.”

ExxonMobil has a huge proved reserve base of 24.8 billion barrels of oil equivalent (or Bboe), which is expected to boost its upstream portfolio. ExxonMobil’s peers BP (BP), Royal Dutch Shell (RDS.A), and Chevron (CVX) are also concentrating on their prolific upstream resources for future growth.

BP, RDS.A, and CVX have reserves of 17.1 Bboe, 11.7 Bboe, and 11.2 Bboe, respectively, which should drive their future growths. If you’re looking for exposure to integrated energy sector stocks, you can consider the iShares North American Natural Resources ETF (IGE). The ETF has ~22% exposure to the industry.