Marc Lasry on Energy Sector: A Good Opportunity?

According to Marc Lasry, heavy oil-weighted (USO) (UCO) (UWTI) stocks could be a better bet in the overall energy sector.

Jan. 9 2017, Published 9:55 a.m. ET

Marc Lasry on the energy sector

Activist investor Marc Lasry spoke about investment opportunities in the energy sector in his January 4, 2017, interview with CNBC. He believes there’s still great opportunities in the energy sector.

According to Lasry, heavy oil-weighted (USO) (UCO) (UWTI) stocks could be a better bet in the overall energy sector (XLE). He emphasized that the energy sector’s distressed debt could provide a good investment opportunity.

The discussion also focused on possible mergers and acquisitions of oil companies that are looking to increase their profit margins. OPEC (Organization of the Petroleum Exporting Countries) and some non-OPEC countries are planning to cut production beginning this month. That could be an important catalyst for crude oil prices in 2017. Currently, crude oil active futures are trading at $53.99 per barrel, a 106.0% rise from the 12-year low on February 11, 2016.

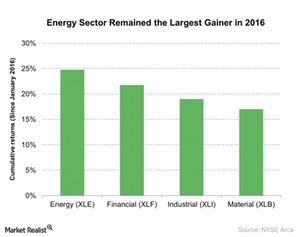

Energy sector in 2016

The energy sector remained the largest gainer in 2016. When global growth concerns increased in January 2016, the energy sector showed a huge fall in performance. But then the Energy Select Sector SPDR ETF (XLE) rose nearly 24.8% in 2016. Crude oil (USO) (UCO) and commodity prices (DBC) recovered from their multiyear lows in February 2016.

Crude oil prices generally move higher when there’s demand in the economy. When there’s an expectation for economic growth, demand tends to rise. Energy stocks such as Exxon Mobil (XOM), Chevron (CVX), and Schlumberger (SLB) rose 16.6%, 32.6%, and 21.7%, respectively, in 2016.

For more information, you may be interested in reading Will Past Be Prologue? Analyzing the US Market’s 2017 Outlook.