What Caused the Gap in Netflix’s Gross and Other Profit Margins?

Netflix’s income from operations totaled $0.9 billion in the first half of 2018.

Oct. 1 2018, Updated 9:00 a.m. ET

How have Netflix’s profit margins changed?

Netflix’s (NFLX) revenues improved by 40.0% to $7.6 billion in the first half of 2018. International streaming memberships drove its revenue growth, followed by domestic streaming and partially offset by a decline in domestic DVD memberships.

Cost of revenues and revenue growth

Netflix’s cost of revenues rose by 26.0% to $4.5 billion in the first half of 2018. Content amortization of streaming content drove these expenses, partially offset by the declining cost of revenues for domestic DVDs. However, these costs consumed 59.0% of its revenues in the first half of 2018 compared to 66.0% in the first half of 2017.

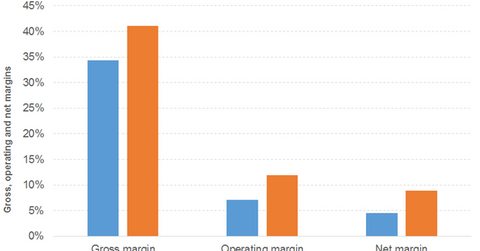

Stronger revenue growth and cost controls translated into gross profit growth of 68.0% in the first half of 2018. Netflix’s gross profit totaled $3.1 billion in the first half of 2018. Its gross margin improved from 34.0% in the first half of 2017 to 41.0% in the first half of 2018.

Operating and other expenses

Netflix’s operating expenses increased by 50.0% to $2.2 billion in the first half of 2018. Its technology and development expenses as a percentage of revenues declined slightly in the first half of 2018.

Its general and administrative expenses as a percentage of revenue remained the same during the first halves of 2017 and 2018. The company’s operating expenses margin comprised 29.0% of revenues in the first half of 2018 compared to 27.0% of revenues in the first half of 2017.

These factors led to 136.0% growth in income from operations in the first half of 2018. Income from operations totaled $0.9 billion in the first half of 2018. The company’s operating margin improved from 7.0% in the first half of 2017 to 12.0% in the first half of 2018.

Netflix’s interest and other expenses remained at 2.0%–3.0% of revenues for the first half of 2017 and the first half of 2018. These factors led its net income to increase by 177.0% to $0.7 billion in the first half of 2018. The company’s net margin rose from 4.0% in the first half of 2017 to 9.0% in the first half of 2018. Its EPS improved by 173.0% to $1.50 in the first half of 2018.

Netflix’s operating and net margins still trail due to the company’s higher operating expense margin. However, Facebook (FB), Apple (AAPL), and Alphabet (GOOG) enjoy relatively healthier margins. Facebook, Alphabet, and Amazon (AMZN) had net margins of 40.0%, 24.0%, and 4.0%, respectively, in the first half of 2018. Apple had a net margin of 22.0% in the nine months ended June 30.