Home Depot’s Valuation Compared to Its Peers

Among the 33 analysts that follow Home Depot, 72.7% recommended a “buy,” while 27.3% recommended a “hold.”

March 1 2019, Updated 7:30 a.m. ET

Valuation multiple

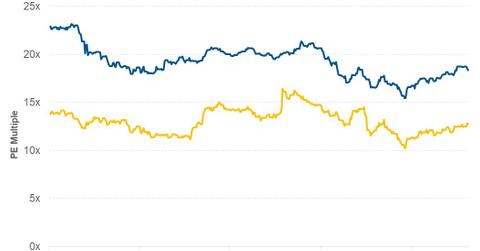

Weak fourth-quarter sales and the lower-than-expected 2019 EPS guidance provided by Home Depot’s (HD) management might have led to a fall in the company’s stock price and its valuation multiple. As of February 26, Home Depot was trading at a forward PE (price-to-earnings) ratio of 18.4x—compared to 18.5x before the announcement of its fourth-quarter earnings.

In the following chart, you can see that Home Depot is trading above its peers’ median valuation multiple. Strong same-store sales growth and higher margins allowed Home Depot to trade at a higher valuation multiple. On the same day, Lowe’s (LOW), Williams-Sonoma (WSM), and Bed Bath & Beyond (BBBY) were trading at a forward PE ratio of 17.4x, 12.8x, and 9.4x, respectively.

Analysts’ recommendations

Among the 33 analysts that follow Home Depot, 72.7% recommended a “buy,” while 27.3% recommended a “hold.” None of the analysts recommended a “sell.” On average, analysts have set a 12-month target price of $203.46, which represents an upside potential of 8.1% from its closing price of $188.03 on February 26. After the announcement of Home Depot’s fourth-quarter earnings, Jefferies lowered its target price from $228 to $218.

Peer comparisons

Among the 31 analysts that follow Lowe’s (LOW) stock, 71% recommended a “buy,” while 29% recommended a “hold.” On average, analysts have set a 12-month target price of $111.0 on the stock, which represents a potential return of 5.7% from its price of $105.03.

Among the 23 analysts that follow Williams-Sonoma (WSM), 4.3% recommended a “buy,” 73.9% recommended a “hold,” and 21.7% recommended a “sell.” On average, analysts have set a 12-month target price of $54.69 on the stock, which represents a fall of 3.9% from its stock price of $56.89.

Among the 21 analysts covering Bed Bath & Beyond (BBBY), 57.1% recommended a “hold,” while 42.9% recommended a “sell.” The average 12-month target price of $13.00 implies a 21.6% downside from the stock’s current price of $16.58.