Citigroup Upgrades Avery Dennison to a ‘Buy’

Avery Dennison rose 1.4% to close at $72.40 per share on January 6. The stock’s weekly, monthly, and YTD price movements were 2.5%, -1.1%, and 3.1%.

Jan. 10 2017, Updated 10:37 a.m. ET

Price movement

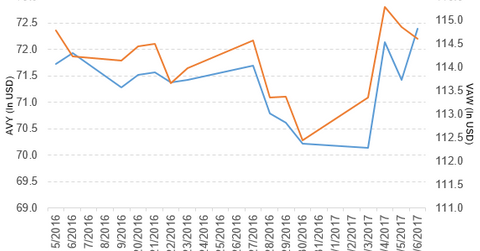

Avery Dennison (AVY) has a market cap of $6.5 billion and rose 1.4% to close at $72.40 per share on January 6, 2017. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 2.5%, -1.1%, and 3.1%, respectively, on the same day.

AVY is now trading 0.94% above its 20-day moving average, 1.7% above its 50-day moving average, and 1.7% below its 200-day moving average.

Related ETF and peers

The Vanguard Materials ETF (VAW) invests 0.93% of its holdings in Avery Dennison. The YTD price movement of VAW was 1.9% on January 6.

The market caps of Avery Dennison’s competitors are as follows:

AVY’s rating and performance in 3Q16

On January 6, 2017, Citigroup has upgraded Avery Dennison’s rating to a “buy” from “neutral.”

Avery Dennison reported 3Q16 net sales of $1.51 billion, a rise of 2.7% from $1.47 billion in 3Q15. Sales from the company’s Pressure-Sensitive Materials and Retail Branding and Information Solutions segments rose 3.7% and 1.1%, respectively. Sales from its Vancive Medical Technologies segment fell 20.5% between 3Q15 and 3Q16. The company’s gross profit margin expanded ten basis points during the same period.

AVY’s net income and EPS (earnings per share) rose to $89.1 million and $0.98, respectively, in 3Q16, as compared to $81.7 million and $0.88, respectively, in 3Q15. Its cash and cash equivalents and inventories rose 31.7% and 10.3%, respectively, between 3Q15 and 3Q16.

Its current ratio fell to 1.0x, and its debt-to-equity ratio rose to 3.4x in 3Q16, as compared to 1.3x and 3.0x, respectively, in 3Q15.

Projections

Avery Dennison projects EPS of $3.50–$3.55 for 2016. It also expects adjusted EPS of $3.95–$4.00, which excludes $0.15 per share for restructuring charges and other items and $0.30 per share for non-cash charges to settle its US pension obligations for 2016.

Now we’ll look at Fortune Brands Home & Security (FBHS).