Can Off-Price Retailers Sustain Same-Store Sales Growth in 2016?

While department stores like Macy’s struggled to report decent numbers in 2015, off-price retailers have continued to display their strength.

March 30 2016, Published 5:44 p.m. ET

Off-price retailers show strength

While department stores like Macy’s (M) struggled to report decent numbers in an uncertain retail environment in 2015, off-price retailers have continued to display their strength. Off-price retailers sell their merchandise at a 20%–80% discount compared to similar merchandise sold in department stores. The major off-price retailers in the US are TJX Companies (TJX), Ross Stores (ROST), and Burlington Stores (BURL).

To attract bargain-hunting consumers, department stores are thus looking for growth opportunities in the off-price space. Macy’s opened six Macy’s Backstage off-price stores in 2015 and is planning further growth in this space. Kohl’s (KSS) opened its first Off-Aisle store in 2015 and now plans to open two more stores in 2016.

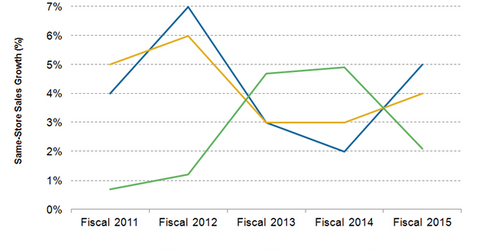

Same-store sales comparison

Same-store sales growth is an important performance metric for retailers. It measures the change in the sales of the existing stores of a retailer over a certain period of time, excluding the impact of the stores closed and opened during the period. For fiscal 2015 (ended January 30, 2016), TJX Companies, the largest off-price retailer, reported same-store sales growth of 5%, compared to 2% in the prior fiscal year. The company attributed this improvement to strong consumer traffic. The PowerShares Dynamic Large Cap Growth ETF (PWB), notably, has 1.4% exposure to TJX Companies.

Ross Stores reported same-store sales growth of 4% in fiscal 2015, topping the previous year’s growth rate of 3%. The same-store sales growth in fiscal 2015 was driven by higher traffic and increased average basket size. By comparison, Burlington Stores’ fiscal 2015 same-store sales increased by 2.1%, down from the 4.9% same-store sales growth it saw in fiscal 2014.

Overall, TJX Companies reported higher same-store sales growth compared to Ross Stores and Burlington Stores. (For more information on TJX Companies’ fourth quarter performance, check out Off-Price Retailer TJX Companies Is on a Roll after Fiscal 4Q16.) For the fiscal year ending January 28, 2017, both TJX Companies and Ross Stores expect same-store sales growth of 1%–2%. Burlington Stores expects its same-store sales to increase in the range of 2.5%–3.5% in fiscal 2016.

Series overview

In this series on off-price retailers, we’ll compare their performance with metrics like margins and inventory management. This series will also discuss their store growth plans, dividend and share repurchases, stock price movement in 2016, and analyst expectations for the current fiscal year.

Let’s start by looking at profitability and seeing which major player holds first place.