Why Did Moody’s Rate Dr Pepper Snapple Senior Notes as Baa1?

Dr Pepper Snapple Group (DPS) declared a quarterly dividend of $0.53 per share on its common stock. This dividend will be paid on January 5, 2017, to shareholders of record on December 13, 2016.

Dec. 4 2020, Updated 10:52 a.m. ET

Price movement

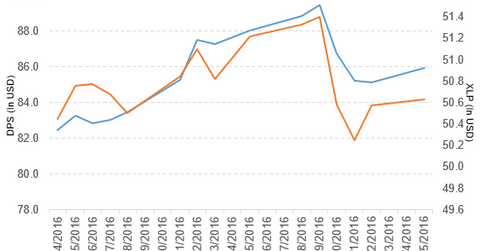

Dr Pepper Snapple Group (DPS) has a market cap of $15.8 billion. It rose 0.96% to close at $85.95 per share on December 5, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -3.2%, -0.82%, and -6.2%, respectively, on the same day.

DPS is trading 0.36% above its 20-day moving average, 1.5% below its 50-day moving average, and 5.4% below its 200-day moving average.

Related ETF and peers

The Consumer Staples Select Sector SPDR ETF (XLP) invests 1.1% of its holdings in DPS. The YTD price movement of XLP was 2.0% on December 5.

The market caps of DPS’s competitors are as follows:

Latest news on DPS

In a press release on December 5, 2016, Moody’s reported, “Moody’s Investors Service today assigned a Baa1 rating to Dr Pepper Snapple Group, Inc. (‘DR Pepper’ or ‘DPSG’) for its issuance of senior unsecured notes in multiple tranches. The rating outlook is stable. The proceeds will be used to finance the company’s $1.7 billion acquisition of US beverage company Bai Brands, LLC (‘Bai’) and for general corporate purposes. The company’s other ratings were unchanged.”

The report added, “The Baa1 senior unsecured rating is based on the company’s solid portfolio of brands, many with leadership positions in their sub-categories, strong profitability, and good product diversity. The company’s rating is also supported by strong liquidity and a balanced financial policy.”

Performance of Dr Pepper Snapple in 3Q16

Dr Pepper Snapple (DPS) reported 3Q16 net sales of $1.7 billion, a rise of 3.1% compared to its net sales of $1.6 billion in 3Q15. Sales of its beverage concentrates and packaged beverages rose 4.9% and 3.6%, respectively, and sales of its Latin American beverages fell 6.2% in 3Q16 compared to 3Q15. The company’s gross profit margin and operating margin expanded 60 basis points and 150 basis points, respectively, in 3Q16, compared to 3Q15.

DPS’s net income and EPS (earnings per share) rose to $240.0 million and $1.29, respectively, in 3Q16, compared to $202.0 million and $1.05, respectively, in 3Q15. It reported adjusted EPS of $1.18 in 3Q16, a rise of 9.3% compared to 3Q15.

Quarterly dividend

Dr Pepper Snapple Group (DPS) declared a quarterly dividend of $0.53 per share on its common stock. This dividend will be paid on January 5, 2017, to shareholders of record on December 13, 2016.

Projections

Dr Pepper Snapple Group has made the following projections for 2016:

- net sales growth of ~2%

- core EPS in the range of $4.32–$4.40

- a core tax rate of ~35%

- capital spending of ~3% of net sales

- the repurchase of $650 million–$700 million worth of its common stock

Next, we’ll look at Coca-Cola (KO).