Why Did MLPI Outperform AMJ?

The ETRACS Alerian MLP Infrastructure Index ETN (MLPI) and the JPMorgan Chase Alerian MLP Index ETN (AMJ) are two of the largest MLP ETNs.

Dec. 9 2016, Published 1:19 p.m. ET

ETFs and ETNs

ETNs are senior unsecured debt securities. ETN investors are exposed to the issuer’s credit risk. ETNs offer investors an easy way to gain exposure to various market indices. The coupons associated with the ETNs are reported by investors as ordinary income on Form 1099, as opposed to K-1 forms required for investments in MLPs and some MLP ETFs.

While there’s credit risk associated with ETNs, investments in ETFs are exposed to tracking error. Tracking error measures the difference in returns between the ETF and its benchmark index over the most recent one-year period.

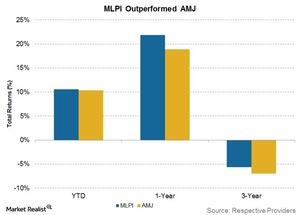

MLPI outperformed AMJ

The ETRACS Alerian MLP Infrastructure Index ETN (MLPI) and the JPMorgan Chase Alerian MLP Index ETN (AMJ) are two of the largest MLP ETNs. As the above graph shows, MLPI outperformed AMJ over the last one-year, three-year, and five-year periods.

Interestingly, both the ETNs invest solely in MLPs. While MLPI tracks the Alerian MLP Infrastructure Index (AMZI), AMJ tracks the Alerian MLP Index (AMZ). AMZ is a 44-member market cap–weighted index made up of energy MLPs. AMZ is broader than the Alerian MLP Infrastructure Index (AMZI). AMZI consists of ~25 energy infrastructure-focused MLPs.

In the next part, we’ll compare how the largest MLP funds performed.