What Does Wall Street Think about Valspar?

As of December 20, 2016, 13 brokerage firms are actively tracking Valspar (VAL)) stock. About 15.0% of those analysts have recommended a “buy” for the stock.

Dec. 23 2016, Updated 9:06 a.m. ET

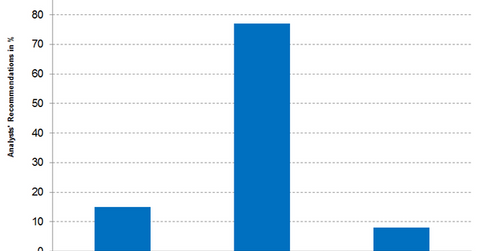

Analyst recommendations for Valspar

As of December 20, 2016, 13 brokerage firms were actively tracking Valspar (VAL)) stock. About 15.0% of those analysts have recommended a “buy” for the stock, and 77.0% have recommended a “hold.” The remaining 8.0% recommend a “sell.”

Analyst consensus indicates a 12-month target price of ~$110.40 for Valspar, implying a return potential of 6.5% based on its closing price of $103.69 on December 20, 2016. Since October, analysts’ consensus target price has risen marginally from $108.67 to the current target price of $110.40.

Peer comparisons

- As of December 20, 2016, 21 brokerage firms were actively tracking Sherwin-Williams (SHW). About 62.0% of them have recommended a “buy” for the stock, and 33.0% have recommended a “hold.” The remaining 5.0% have recommended a “sell.”

- PPG Industries (PPG) is tracked actively by 22 brokerage firms. About 73.0% of them have recommended a “buy” for the stock, and 27.0% have recommended a “hold.” No firms have recommended a “sell.”

- RPM International (RPM) is tracked actively by 12 brokerage firms. About 25.0% of them have recommended a “buy” for the stock, and 75.0% have recommended a “hold.” No firms have recommended a “sell.”

ETF investment

If you’re looking for exposure to Valspar through ETFs, you can invest in the Vanguard Materials ETF (VAW), which had 1.0% of its portfolio in VAL as of December 20, 2016.